-

CFA三级

包含CFA三级传统在线课程相关提问答疑;

专场人数:1519提问数量:40680

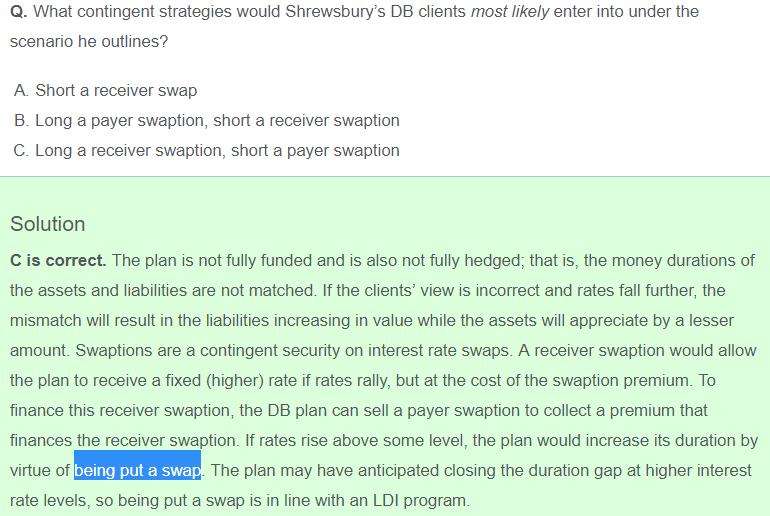

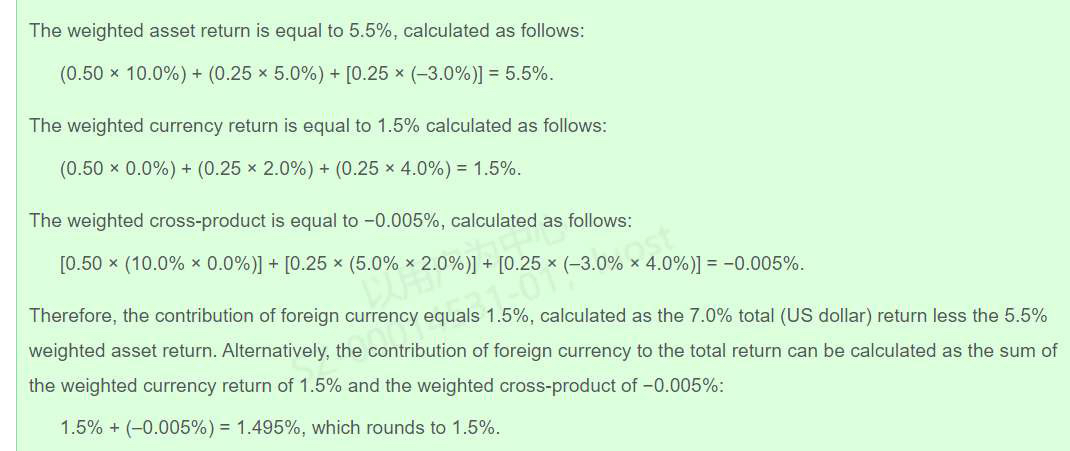

第1,这类题我可以理解为:只要有多类asset,rfc要加权计算;只要有多种货币敞口,rfx也要加权计算 。第2,前面加权平均算出的rfc和rfx可compund算rd,也可直接相加近似等于rdc,对吗?

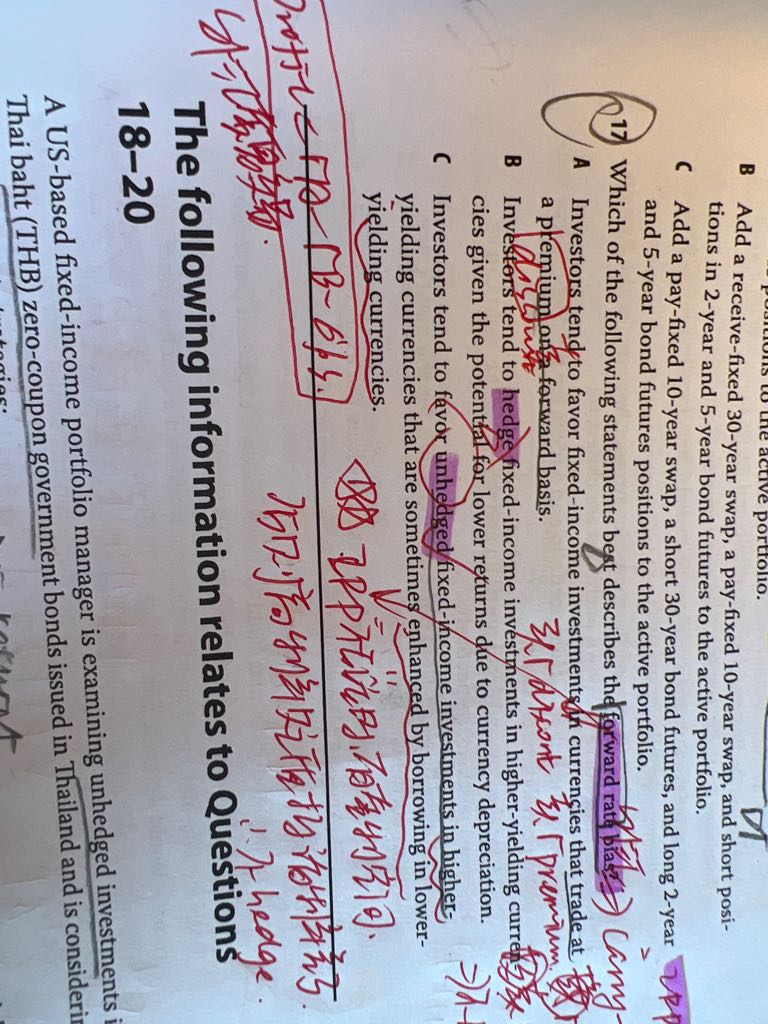

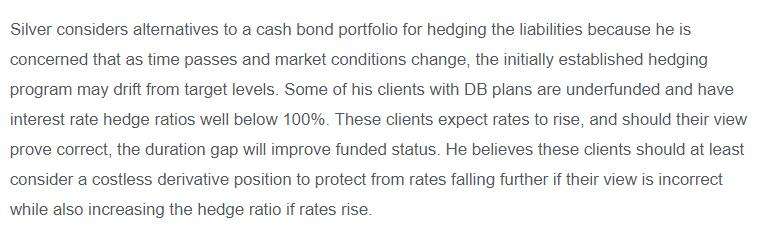

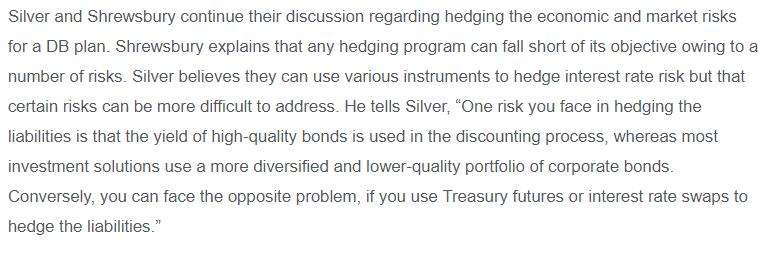

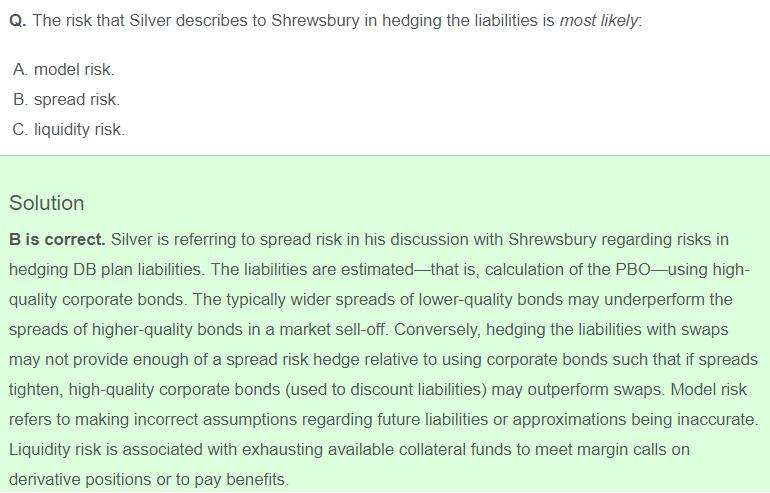

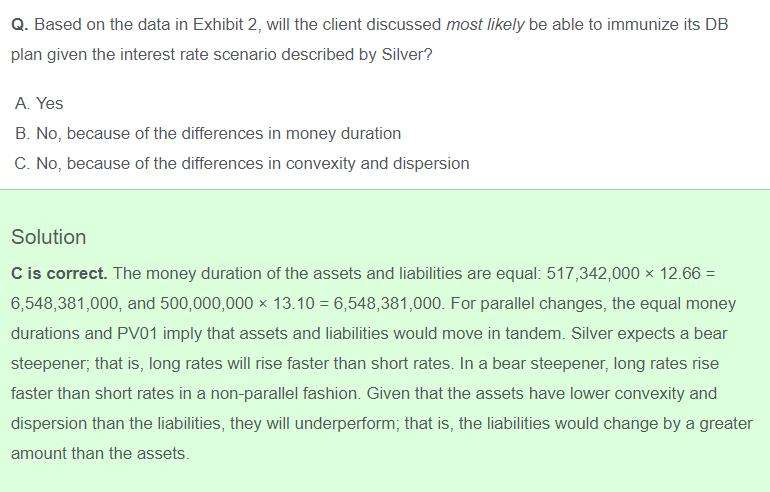

固收官网题 这个题 不懂 另外书上这段话也不懂 Another source of spread risk is the use of interest rate swap overlays. We showed how receive-fixed swaps, purchased receiver swaptions, and swaption collars can reduce the duration gap between pension plan assets and liabilities. In that example, ΔHedge Yields refers to fixed rates on interest rate swaps referencing the three-month MRR. The spread risk is between high-quality corporate bond yields and swap rates. Typically, there is less volatility in the corporate/swap spread than in the corporate/Treasury spread because both the MRR and corporate bond yields contain credit risk vis-à-vis Treasuries. Therefore, one of the usual advantages to hedging corporate bond risk with interest rate swaps is that those derivatives pose less spread risk than Treasury futures contracts. 麻烦解释一下这里

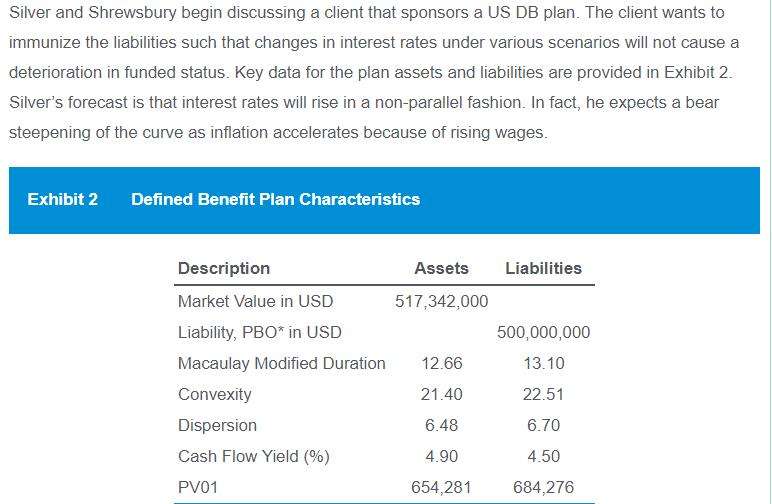

老师 负债的免疫 是 资产的麦考利久期匹配负债的麦考利久期 那为什么多个负债的免疫用资产的money duration 匹配负债的money duration呢? 像这个题目 算money duration就是算BPV 用资产的价值乘以麦考利久期? 不应该是乘以修正久期才对嘛?

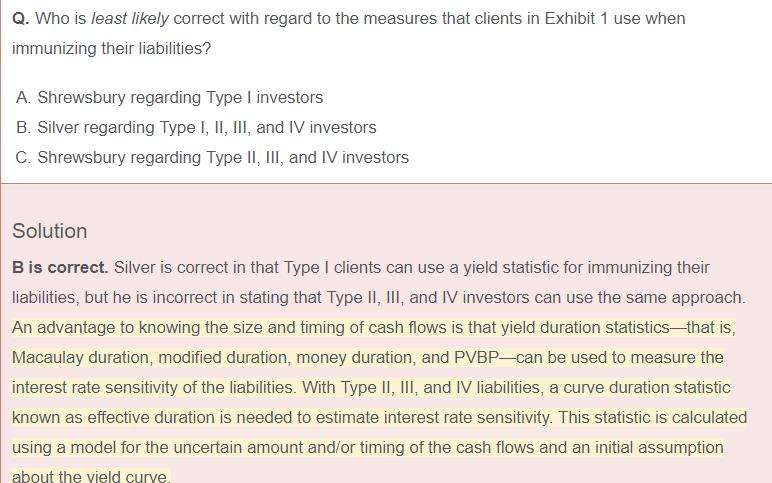

老师 固收官网题这个不懂 Only Type I clients can measure the interest rate sensitivity of liabilities using yield statistics. Those with Type II, III, and IV liabilities must use a curve duration statistic, such as effective duration, to estimate interest rate sensitivity. 这句话是对的 为什么II III IV 类负债都必须要用effective duration?

精品问答

- 第5题,从经济学公式X-M=(S-I)+(T-G)来看,如果经常账户赤字增加,不是意味着该国投资大于储蓄,或政府支出大于税收么,那么整体环境应该是好的,应该有利于资本的流入吧?为什么答案是反过来去赤字减少或盈余的国家呢?

- 这里第二题的意思是三种方法都适用吗?没太理解,能否在讲解下

- 到底该怎么判断一类和二类错误?做的题目解答标准不一致啊,我看到另一道题的版本是 - 一类错误是做了错的事,二类是没做对的事。现在这一题,对于不合格的经理不采取行动,不就是二类错误 - 没做对的事吗?

- 关于什么时候用IRR 、MOIC

- 1.这里右侧支付端这段,party A角度他有market value risk时谁有?上下部分矛盾了啊.2.左侧的图和配文是什么意思?原本是什么?又变成什么?3.注意里面:fixed端有

- security 冷丁 那一副图能不能画给我看下买卖方都经历哪些步骤互相得到什么?

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 她对个人笔记本电脑(personal laptop)进行了完整备份(full backup),并确保备份前已删除所有公司文件(all company files removed)。 目的:确保新备份中不包含任何前公司数据,避免合规风险。 遗留问题: 硬盘上的旧备份(previous backups)仍包含公司文件。 她不想因删除旧备份而丢失个人文件的备份历史(backup history for personal files)。 针对上述分析我有个疑惑,这个人不是已经在自己笔记本上备份了drive上的个人信息吗,怎么又Not wanting to lose the backup history for her personal files呢?他不是已经把自己的私人信息备份了吗!?