-

CFA三级

包含CFA三级传统在线课程相关提问答疑;

专场人数:1520提问数量:40702

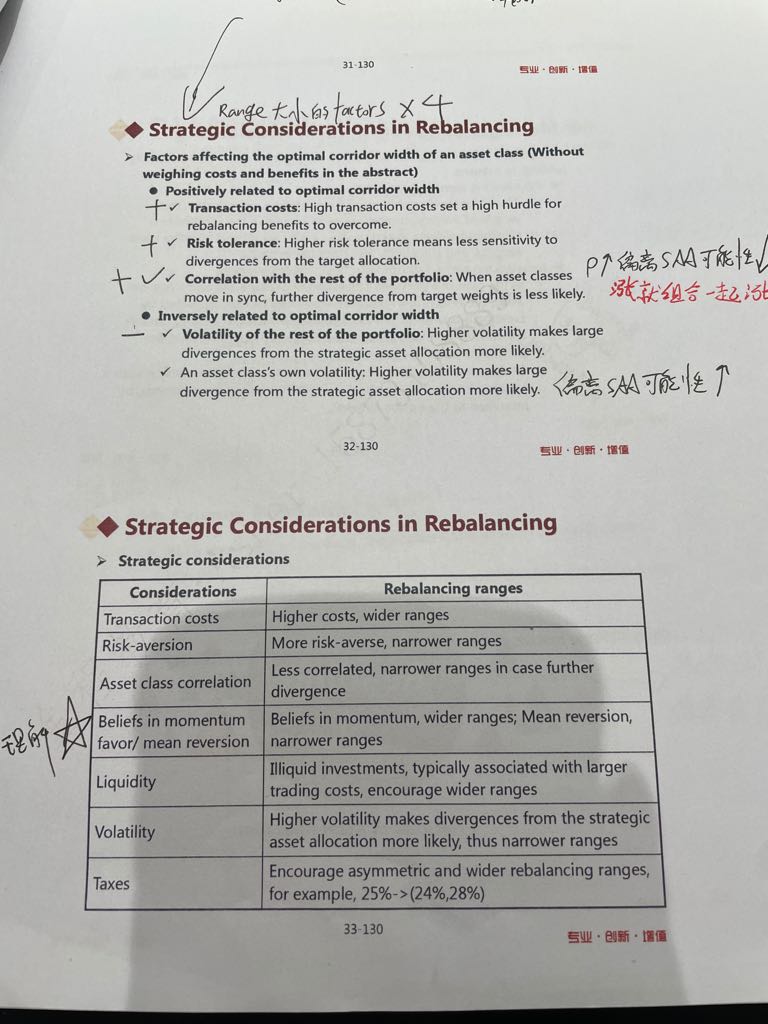

第一个问题,这里说rebalancing偏离 saa可能性越大 越是要小range约束它 否则会越来越偏离saa 但是momentum这种东西 如果越相信momentum 那么一个资产涨 它日后还会涨 此时这个资产就会相比于其他资产涨得越来越多 越来越偏离saa 此时为什么又是wider range呢? 第二个问题,transaction cost和tax增大 也增加range是怎么解释的?

官网题衍生23题,汇率104.15哪来了? The data she uses for her assessment show that the US bonds pay 1.75% and Japanese bonds pay –0.40% annualized. She plans to fully hedge the currency risk. The YEN/USD spot rate is 106.85, the one-year YEN/USD forward rate is 106.12, and the one-year YEN/USD cross currency swap basis is –0.63.A is correct. Stuyvesant can sell US$10,000 converted at a spot rate of 106.85 to invest proceeds of ¥1,068,500 at –0.40%. After one year, the Japanese bonds are sold (1,068,500 × 0.9960 = 1,064,226.00) and converted at the forward rate of 104.15, for proceeds of US$10,218.20. The fund has earned 10,218.20/10,000 – 1 = 2.18%. The 2.18% yield is higher than the 1.75% she could have earned in US Treasury bills. The difference is due to the basis given a high demand for US dollars.

已回答官网题23题答案A中,A is correct. Stuyvesant can sell US$10,000 converted at a spot rate of 106.85 to invest proceeds of ¥1,068,500 at –0.40%. After one year, the Japanese bonds are sold (1,068,500 × 0.9960 = 1,064,226.00) and converted at the forward rate of 104.15, for proceeds of US$10,218.20. The fund has earned 10,218.20/10,000 – 1 = 2.18%. The 2.18% yield is higher than the 1.75% she could have earned in US Treasury bills. The difference is due to the basis given a high demand for US dollars.104.15哪来的?

已回答原版书R22的example12的第三问和第四问,一个问期初一个问期末的tax consequences,这个看了解析也听了课程讲解,不是很理解这两个问题的区别。资本利得税这些不都是在期末才会发生么?我看解释说premium的tax也不是在期初付吧?这两道题麻烦老师再解释一下

已回答老师好,R14经典题-active portfolio manager, 问当20yr YTM steeper 0.20% inscreasing时,为什么 Δspread是正的0.4%,为什么不是负的呢?现在国债收益率上升了, 国债收益和公司债收益率的spread不应该narrow了吗? 我选的B:0.4%, 谢谢老师

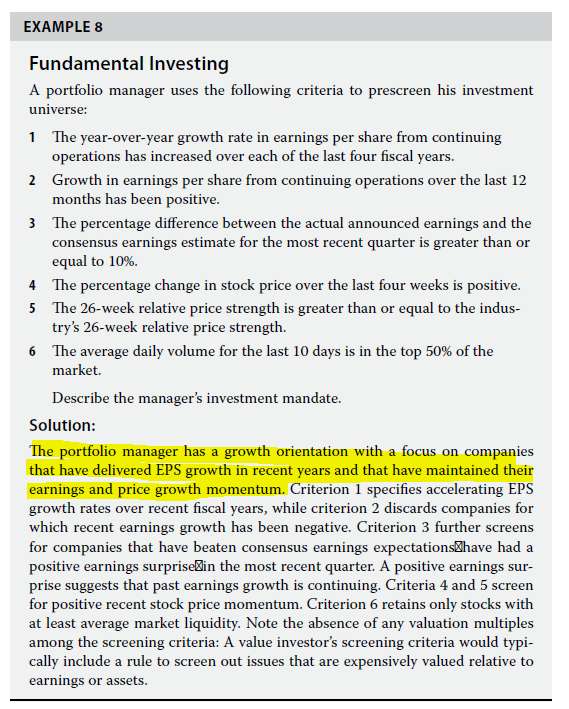

已回答L3V3 P270 EXAMPLE 8. In the exam, is the highlighted sentence well enough to get a full mark for this question?

If an investor want to choose stocks under growth approach, should he evaluate the YoY growth for revenue or net income? Is there any difference between these two?

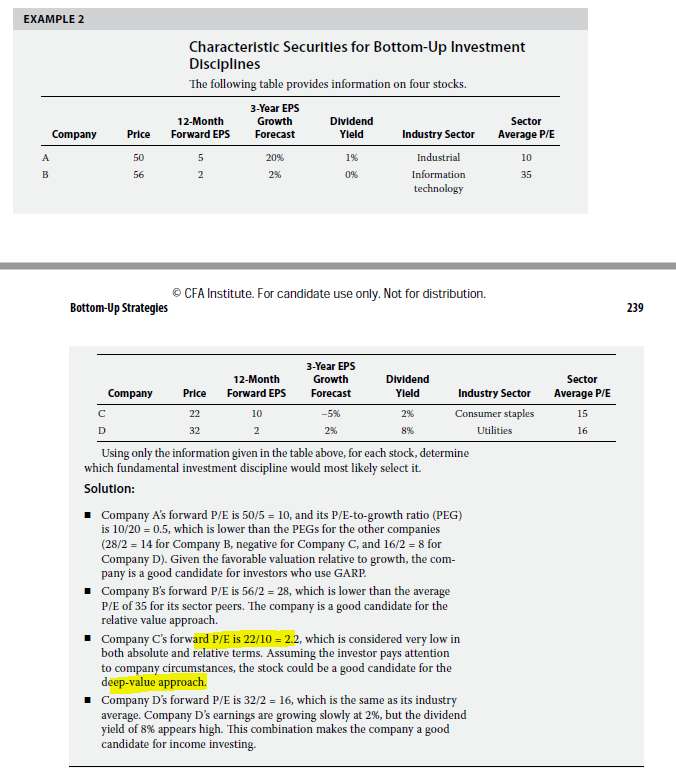

已回答L3V3 p239. In Example B, company C's forward P/E is 2.2, which is absolutely and relatively low compared to other companies. (1) why should not this stock be a good candidate under the relative valuation approach? (2)The solution said it's a good candidate under the deep-value approach. Through definition, deep-value approach chooses low P/B company and company under financial distress. How can I tell the P/B is low and it is under financial distress?

精品问答

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 她对个人笔记本电脑(personal laptop)进行了完整备份(full backup),并确保备份前已删除所有公司文件(all company files removed)。 目的:确保新备份中不包含任何前公司数据,避免合规风险。 遗留问题: 硬盘上的旧备份(previous backups)仍包含公司文件。 她不想因删除旧备份而丢失个人文件的备份历史(backup history for personal files)。 针对上述分析我有个疑惑,这个人不是已经在自己笔记本上备份了drive上的个人信息吗,怎么又Not wanting to lose the backup history for her personal files呢?他不是已经把自己的私人信息备份了吗!?

- 老师第二题 假设激励费的费率都一样 是不是soft会比hard好很多对于GP来说 GP会赚多得多的钱?

- 第二题答案上说的是smaller difference,选项c是wider dispersion 是不是题出错了

- 2022 mock A上午部分,第4题的BC 两问,答案不怎么明白。

- 能否从定义出发解释下CDS price是什么?为什么要这样计算?它在实操中怎么用?

- 这道题约掉百分号我觉得是错误的,因为如果把百分号带入进去,实际结果比题目中的结果大100倍,原版书课后题P106页,我算出来答案是43287,可是结果是4317774,请问我可否说原版书出题不严谨?

- 老师,请详细讲解一下该科目LM3课后题的Q16,我主要对forward rate bias不太理解,谢谢。