ShirleyWan2022-05-29 00:31:05

ShirleyWan2022-05-29 00:31:05

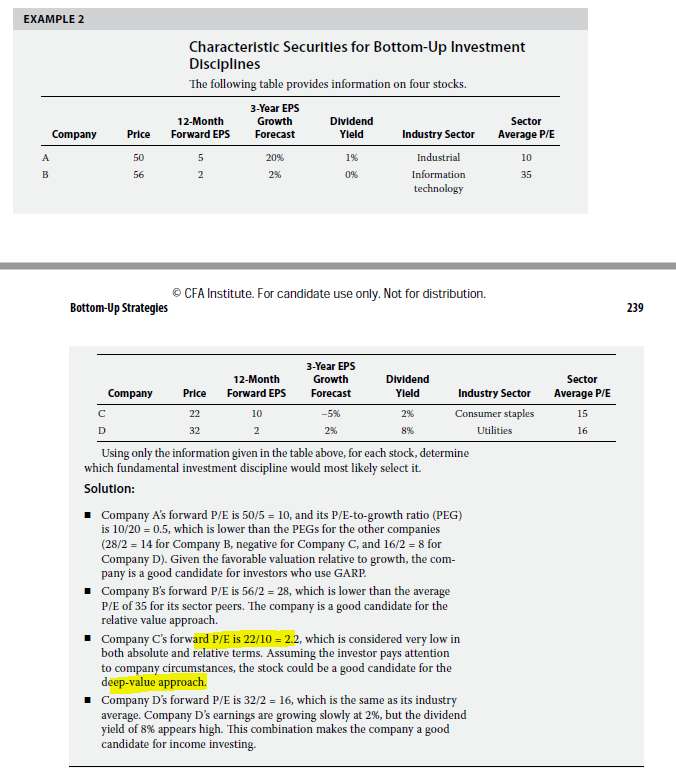

L3V3 p239. In Example B, company C's forward P/E is 2.2, which is absolutely and relatively low compared to other companies. (1) why should not this stock be a good candidate under the relative valuation approach? (2)The solution said it's a good candidate under the deep-value approach. Through definition, deep-value approach chooses low P/B company and company under financial distress. How can I tell the P/B is low and it is under financial distress?

回答(1)

开开2022-05-31 12:30:47

开开2022-05-31 12:30:47

同学你好,

1、因为deep value approach的投资逻辑就是投资估值水平很低的公司。C公司的P/E不论是绝对水平还是相对谁都是很低的,是这种策略会考虑的标的。

2、deep value会投资估值很低的公司,P/E和P/B都是体现估值的指标,但是P/B更加常用,但低P/E也是符合的。估值极低的公司通常是公司财务情况不太好的,所以市场才会压低它的估值。不过这里没说也没法确认,这题还是主要通过低P/E去判断。

【点赞】哟~。加油,祝你顺利通过考试~

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片