-

FRM二级

包含FRM二级传统在线课程、通关课程及试题相关提问答疑;

专场人数:1653提问数量:32275

266题的D选项,参照基础班讲义234页,“Since individual......even if no diversification assumptions are used“ 说:风险汇总过程中,由于单独计量不同风险时未考虑相关性,导致汇总时会underestimate overall risk。那么D选项说,考虑了相关性后,total VaR 会大于等于单独VaR的加总,这个应该就是对的呀!

精品问答

- 不理解这里为什么Risk Chaampions & Business-Line Managers 负责monitor Operational Risk Function Operational Risk Committee 负责act 难道不应该是一线业务人员负责act,然后上一级负责monitor更贴切嘛

- 请问selection bias 与 self-selection bias 有什么区别?我看到一个老师回复的是:不同个体选择样本不同,这就是自选择偏差,是不同个体本身固有的差异。请问这里的不同个体是指不同的人吗?

- 这里的cash 中性是只需要CAPM中的benchmark=0?还是这个benchmark怎么样?什么叫阿尔法不会产生active cash position?CAPM中阿尔法并不在基准中啊?

- 最后一行的对比是啥意思,老师展开解释一下。增量收费和FRTB定义差异

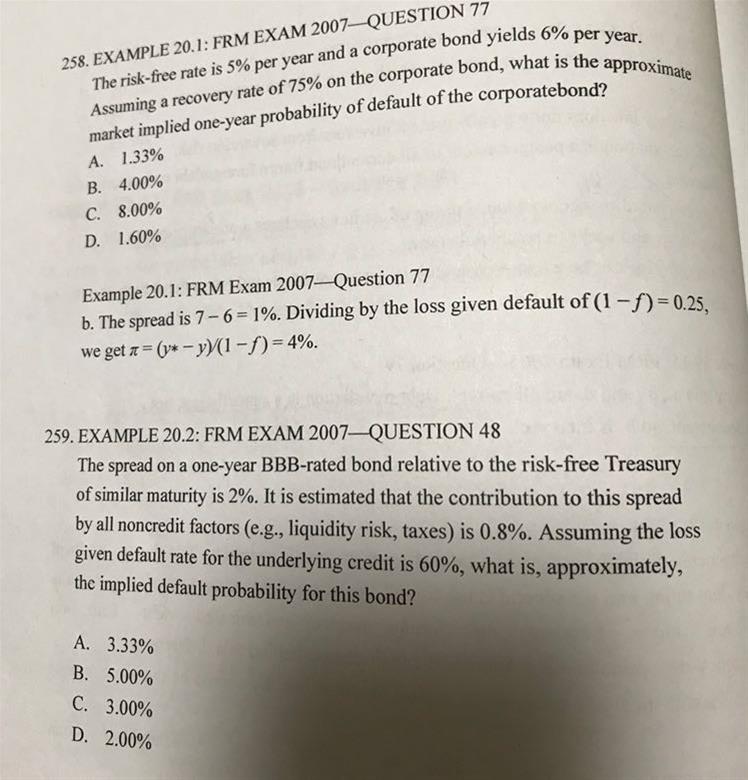

- 能解释一下这道题吗?

- 老师,请问计算式中,组合的Delta是怎么计算出来了的呢?

- 麻烦老师解释一下IRC和SRC,不太理解

- 可以帮我罗列一下二级case 常考的时间和原因结果m