-

CFA二级

包含CFA二级传统在线课程、通关课程及试题相关提问答疑;

专场人数:2452提问数量:55593

第三题,能不能先算出员工工作第一年时的现值,也就是PMT=1247, 算出PV等于13900。然后再计算第二年时PBO的现值等于第一年的现值×2等于27800,然后再得到20818。

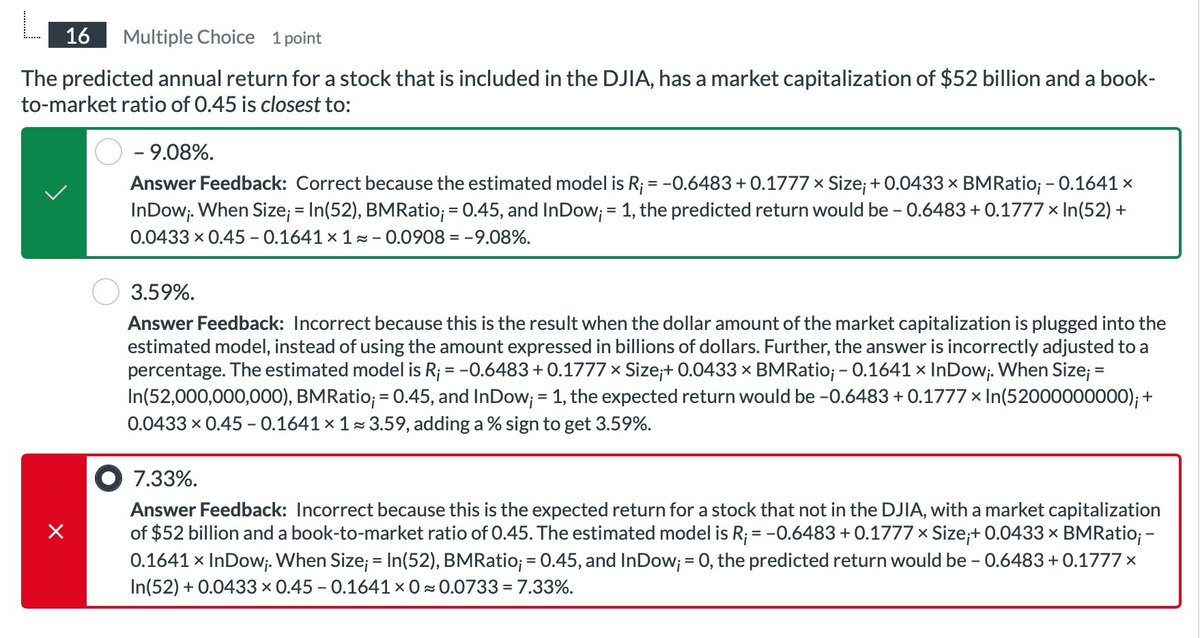

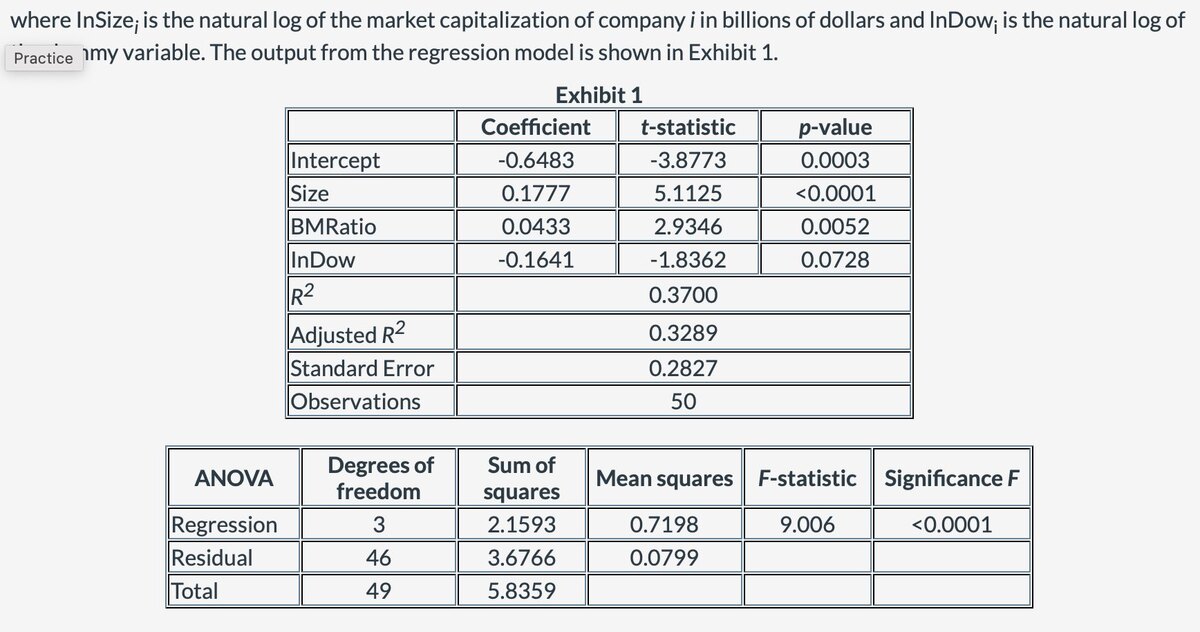

查看试题 未解决老师好,这题对Dummy Variable部分的计算有疑问。题目中有给“lnDowi is the natural log of the dummy variable.”我的理解是:因为该股票包含在DJIA里,dummy variable = 1, 那么lnDowi = ln(1) = 0, 所以计算出的结果是选C,7.33%。而答案的解释是因为该股票包含在DJIA里,所以lnDowi = 1,从而计算出的结果是选A,-9.08%。为什么这儿不用natural log的计算呢?题目中同样有给“InSizei is the natural log of the market capitalization of company i in billions of dollars ”,在计算lnSizei时就运用了natural log。

关于RSU费用确认的问题:课上老师说expense是从grant date的fair value确认金额,然后到vesting期间逐年确认,但是现在题目是在vested那一天直接确认expense,那是哪一个才对的呢?麻烦老师解答~

查看试题 未解决Q9,为什么不是这样计算的呢:先将NVK3/4.1790=FB12.54,也就是在Jul.15将无形资产纳入子公司的Asset, 然后在年底的时候再将资产FB12.54/4.2374=NVK2.96。

查看试题 未解决精品问答

- Growth due to capital deepening 是αΔK/K还是ΔK/K

- 请老师讲解一下这个题目

- 老师,第三题答案的意思是:1.因为宽松的货币政策,导致加元利率下跌,导致加元贬值?2.但是,如果利率下跌,也就是分母上的百分比下降,不是会导致价格上升吗?。3.从而短期看是depreciation,但是长期来看,会回归到均值,所以是appreciation?

- 很迷惑到底是long call+ short stock还是long stock+short call构建无风险资产

- 这道题可不可以用算出来的fpa除以0.9算出的价格和125比较,得出的差额是套利的利润?

- 不太明白为什么AI0 20 加上后 后面AIT 是减50, 为什么要重复计算0~T=2 这段的coupon?

- 第4题 讲义没有讲到,能在详细讲一下吗

- 这题为什么是选C?