-

CFA二级

包含CFA二级传统在线课程、通关课程及试题相关提问答疑;

专场人数:2443提问数量:55528

The dataset is typically divided into three non- overlapping samples: (1) training sample used to train the model, (2) validation sample for validating and tuning the model, and (3) test sample for testing the model’s ability to predict well on new data. The training and validation samples are often referred to as being “in- sample, ” and the test sample is commonly referred to as being “out- of- sample. ”。 原版书说tranning 和 validation sample 都是in sample的 我们的讲义和老师说的是 validation 是out sample的

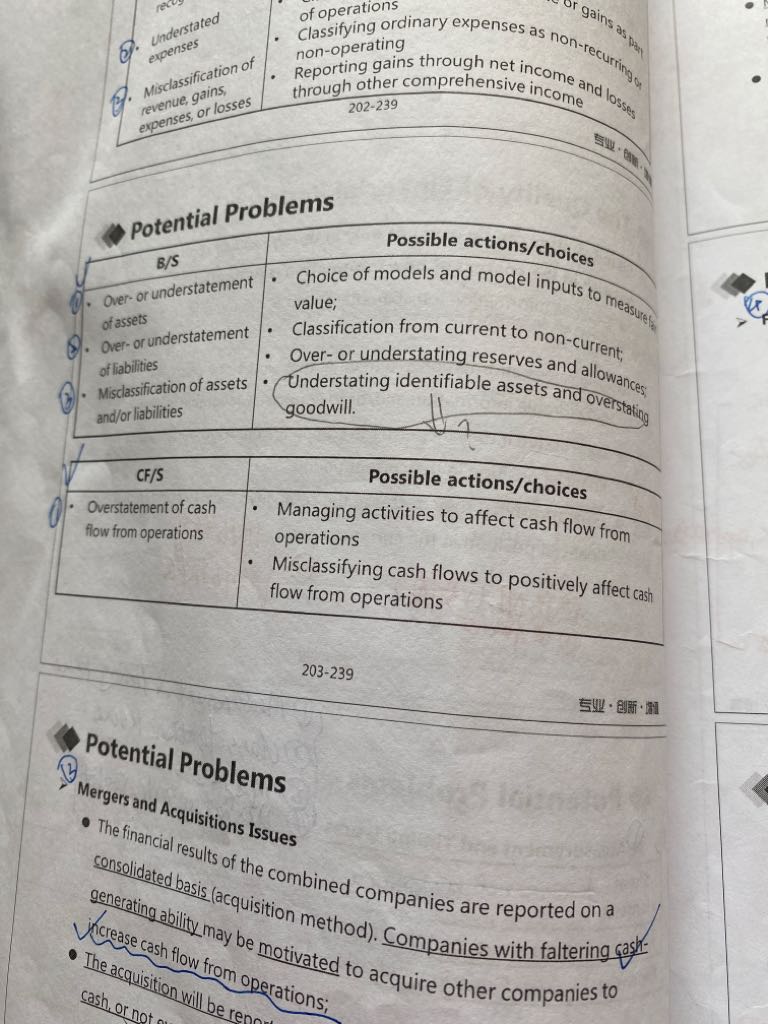

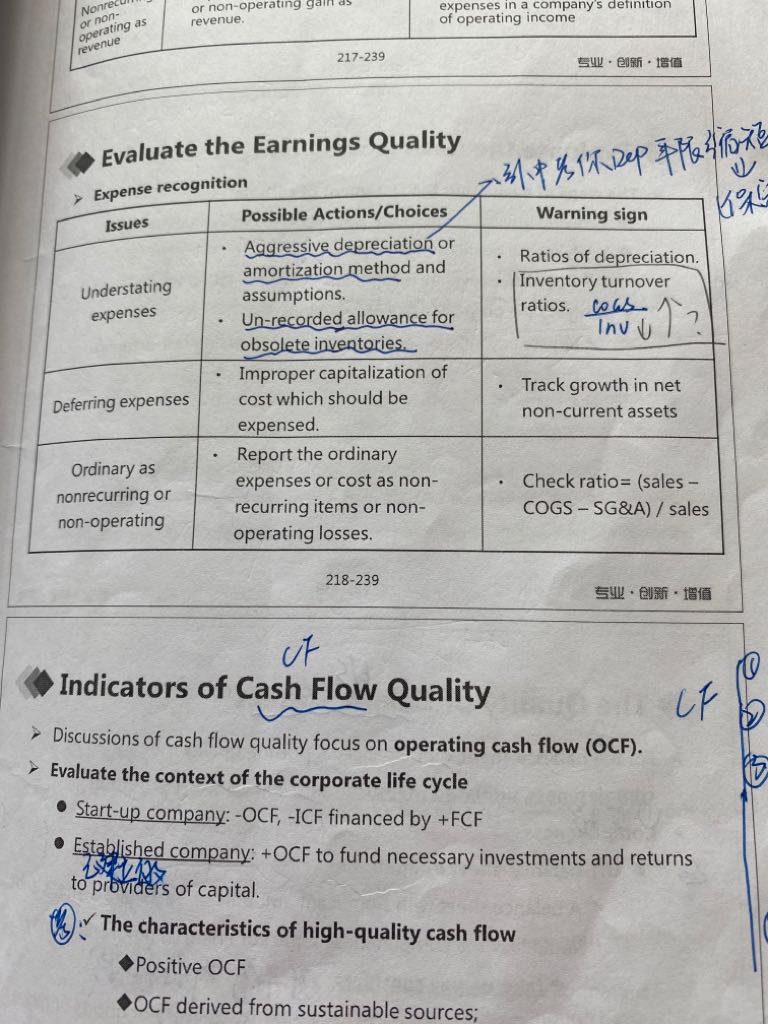

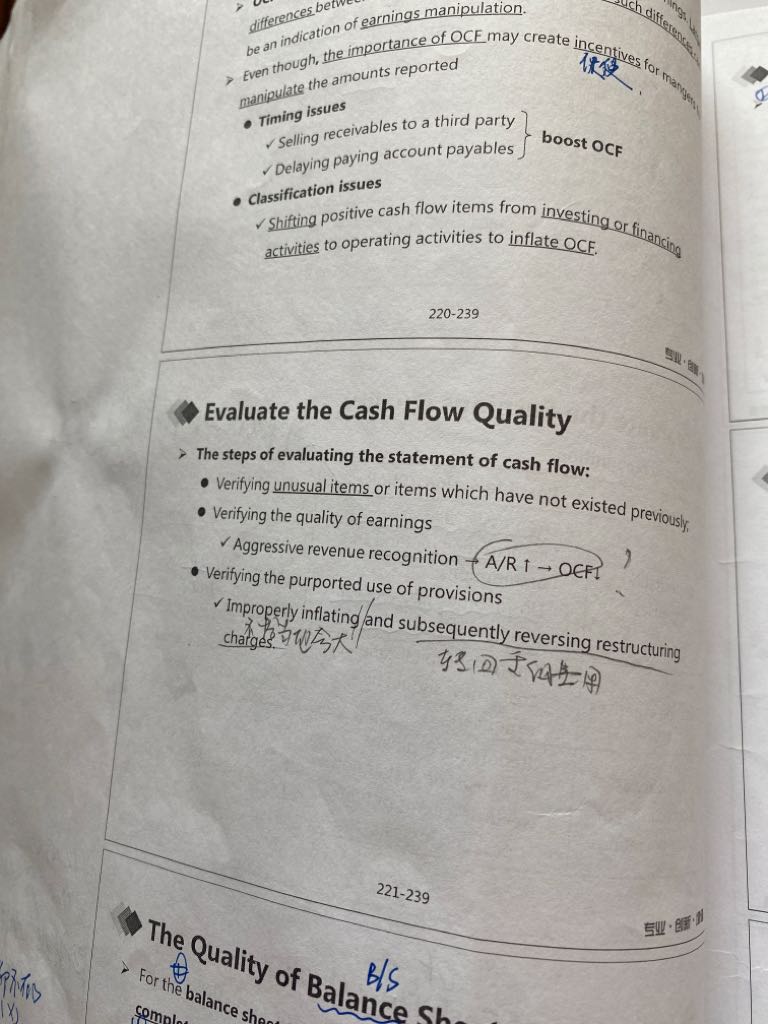

R13 1. 图一 打问号这个地方 低估无形资产和高估GW 这如何能高估资产啊?2. 图二 inven turnover 过高,会带来低估费用,对么?3. 图三打问号出,不明白这怎么就导致ocf 下降了?

精品问答

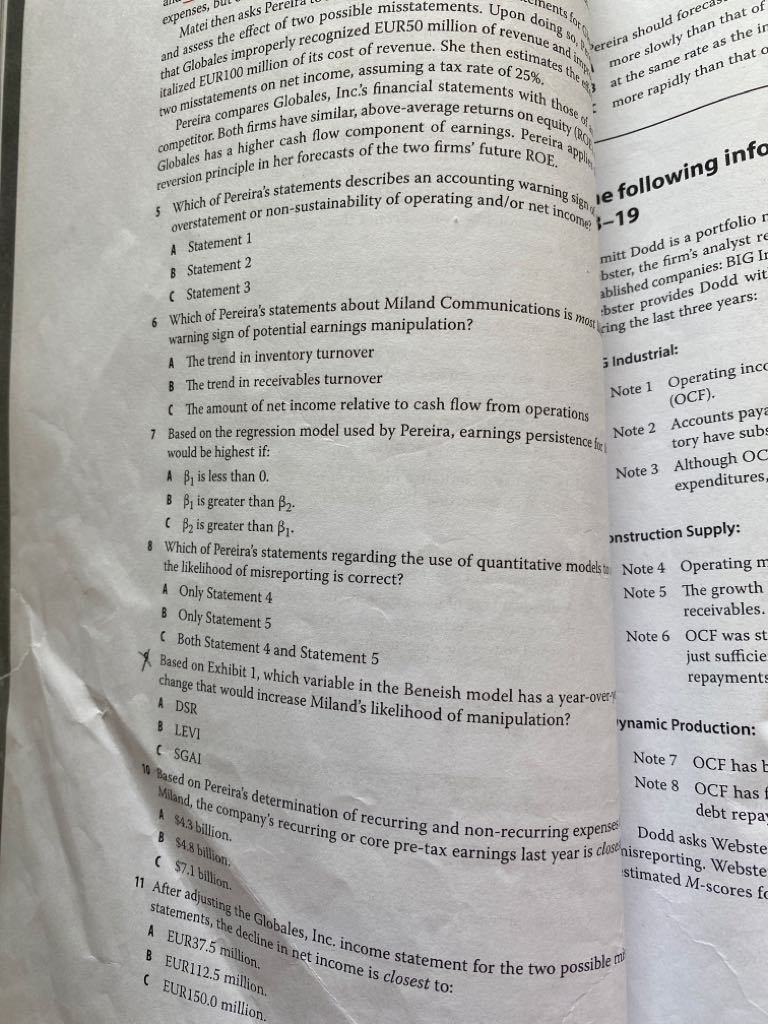

- 这题为什么是选C?

- 老师,第二题可以在解释一下原理吗?

- CDS的long和short是不是反过来的?就是long CDS代表看涨目标公司credit,所以是卖出一份CDS合约?

- 为啥accrued interest over contract life是0?

- 老師您好,Q1關於future price不太理解

- 这个1.0028的单位是什么 老师说“每一块钱SF的现值” 如果是*1.12 就是期初先 euro 转 sf 然后 期末再 /1.1 就是 sf 转 euro ?

- 第六题,视频老师说,对于汇率都是先除老汇率再乘新汇率,不应该吧,对于这个客户而言,因为“paying €1 million at inception.“得出该客户是未来每期是收欧元利息和欧元本金,支瑞士法郎利息和本金。所以期初是每一欧元换1.12瑞士法郎用的是乘呀,估值时的汇率1.1用除。老师帮忙看看逻辑正确不?

- Growth due to capital deepening 是αΔK/K还是ΔK/K