-

CFA问答

CFA问答包含CFA在线课程、CFA通关课程、CFA试题等所有CFA相关问题,每个问题老师均会在24小时内给出答疑回复哦!

专场人数:0提问数量:0

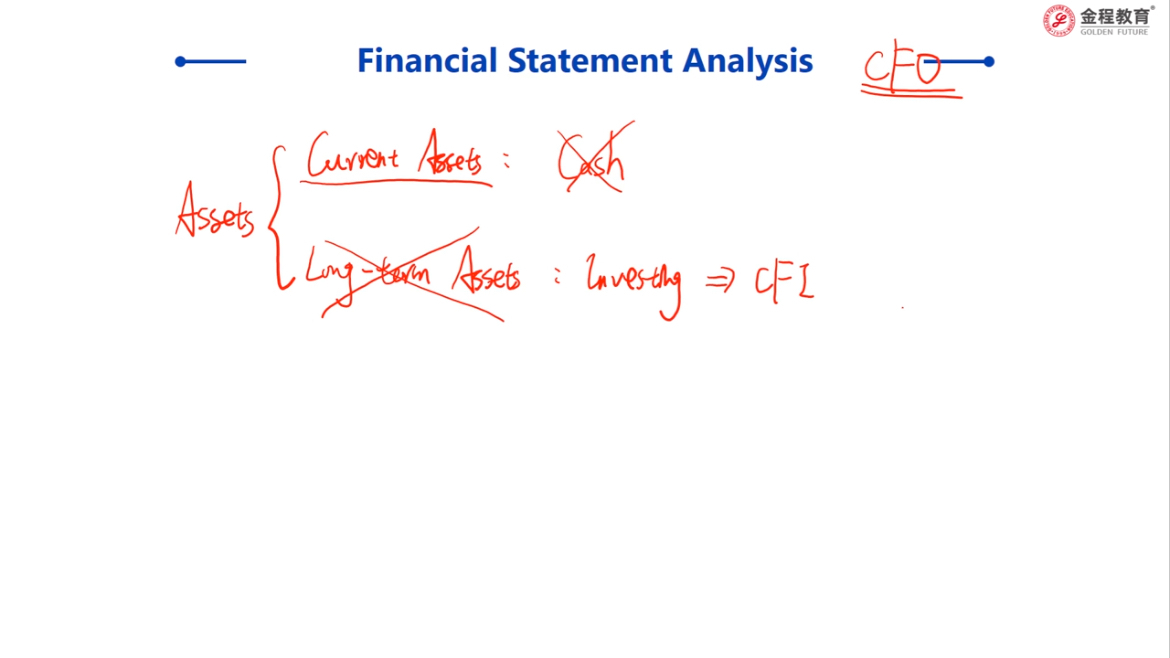

老师这个题我是先算了存货,存货变动4+16+2(A/P)=22,37-22=15 15+3=18 最后再把题干中的项目挨个减去得到6 这么做正确吗?? 考试时候如何分辨直接法还是间接法,感觉脑子有点乱,套公式的时候不知道该用哪一套

查看试题 已回答精品问答

- 为什么长期垄断竞争中 D和ATC相切

- m上升 EAR为什么上升 以及为什么又不变

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 第5题,从经济学公式X-M=(S-I)+(T-G)来看,如果经常账户赤字增加,不是意味着该国投资大于储蓄,或政府支出大于税收么,那么整体环境应该是好的,应该有利于资本的流入吧?为什么答案是反过来去赤字减少或盈余的国家呢?

- 为什么可以把TR TC同时体现在纵轴?

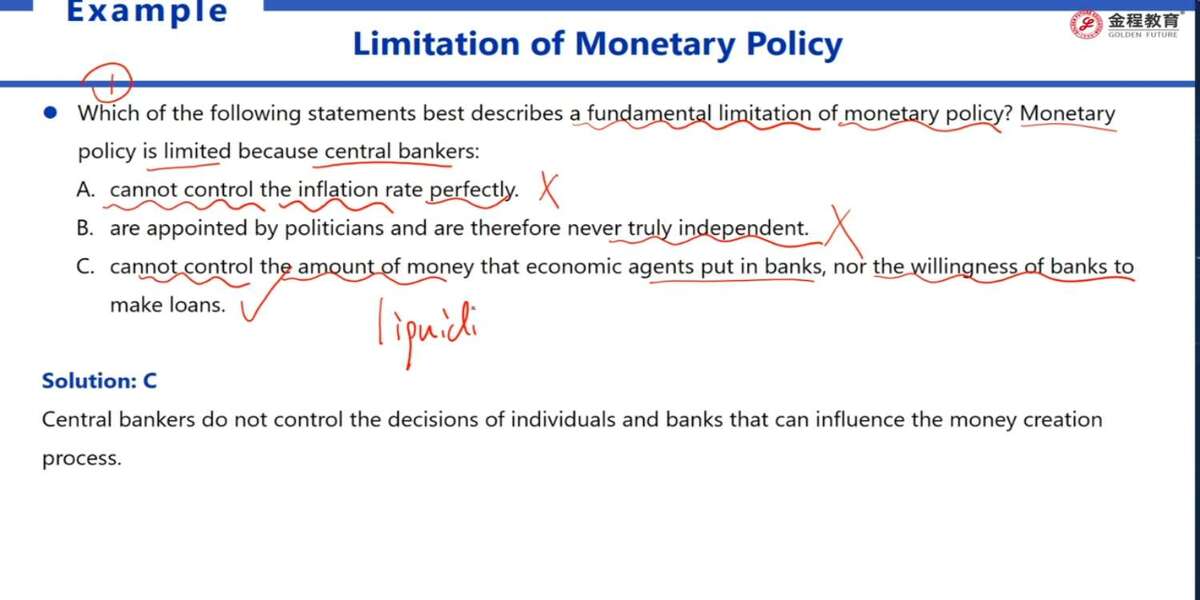

- 这题为什么是选C?

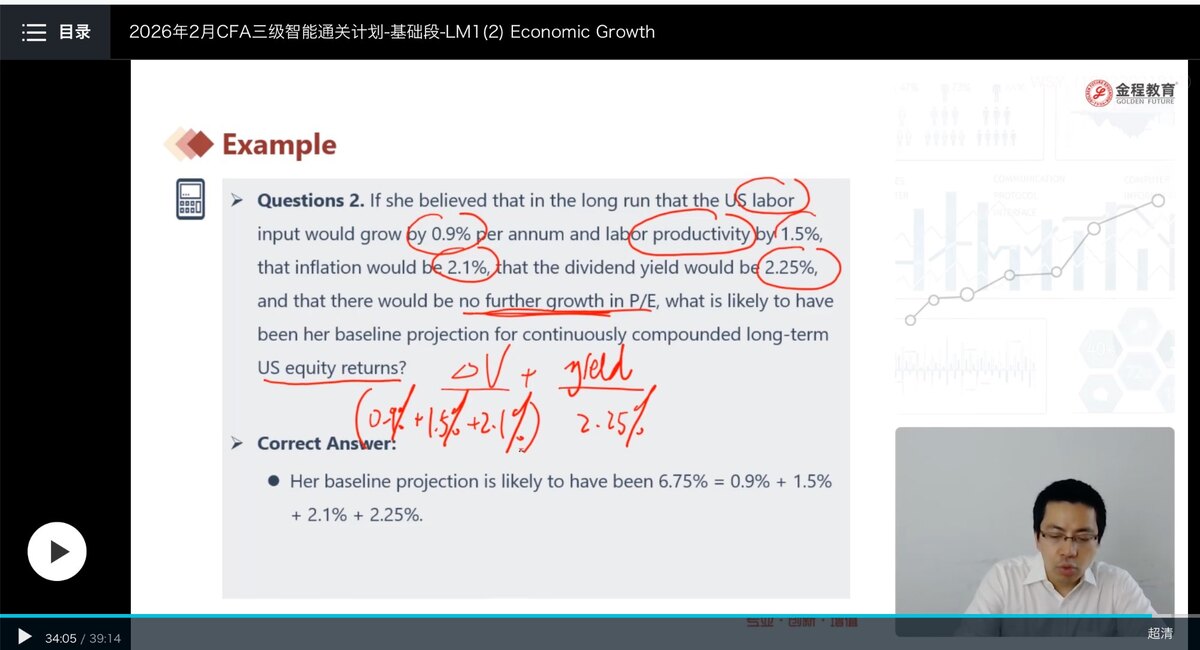

- 老师,第二题可以在解释一下原理吗?

- 老师第二题 假设激励费的费率都一样 是不是soft会比hard好很多对于GP来说 GP会赚多得多的钱?