-

CFA问答

CFA问答包含CFA在线课程、CFA通关课程、CFA试题等所有CFA相关问题,每个问题老师均会在24小时内给出答疑回复哦!

专场人数:0提问数量:0

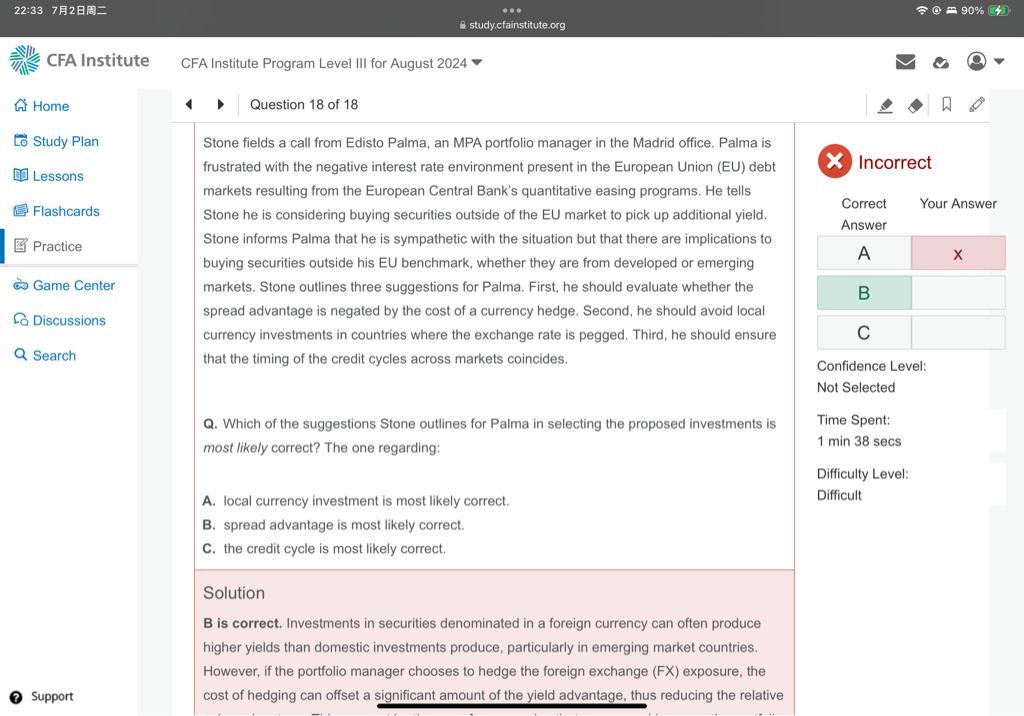

Eastland and Northland (with currencies pegged to each other) will share the same yield curve if two conditions are met. First, unrestricted capital mobility must occur between them to ensure that risk-adjusted expected returns will be equalized. Second, the exchange rate between the currencies must be credibly fixed forever. Thus, as long as investors believe that there is no risk in the future of a possible currency appreciation or depreciation, Eastland and Northland will share the same yield curve. A shift in investors’ belief in the credibility of the fixed exchange rate will likely cause risk and yield differentials to emerge. This situation will cause the (default-free) yield curve to differ between Eastland and Northland. 这段话说的是什么意思,总结下来是三元悖论哪个不满足?

已回答Q4,comparable company analysis provide an estimate of the fair stock price,这么描述是对的?那可比公司法提供了什么呢?(相同的描述逻辑下)

查看试题 已解决精品问答

- 为什么长期垄断竞争中 D和ATC相切

- Growth due to capital deepening 是αΔK/K还是ΔK/K

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 第5题,从经济学公式X-M=(S-I)+(T-G)来看,如果经常账户赤字增加,不是意味着该国投资大于储蓄,或政府支出大于税收么,那么整体环境应该是好的,应该有利于资本的流入吧?为什么答案是反过来去赤字减少或盈余的国家呢?

- 她对个人笔记本电脑(personal laptop)进行了完整备份(full backup),并确保备份前已删除所有公司文件(all company files removed)。 目的:确保新备份中不包含任何前公司数据,避免合规风险。 遗留问题: 硬盘上的旧备份(previous backups)仍包含公司文件。 她不想因删除旧备份而丢失个人文件的备份历史(backup history for personal files)。 针对上述分析我有个疑惑,这个人不是已经在自己笔记本上备份了drive上的个人信息吗,怎么又Not wanting to lose the backup history for her personal files呢?他不是已经把自己的私人信息备份了吗!?