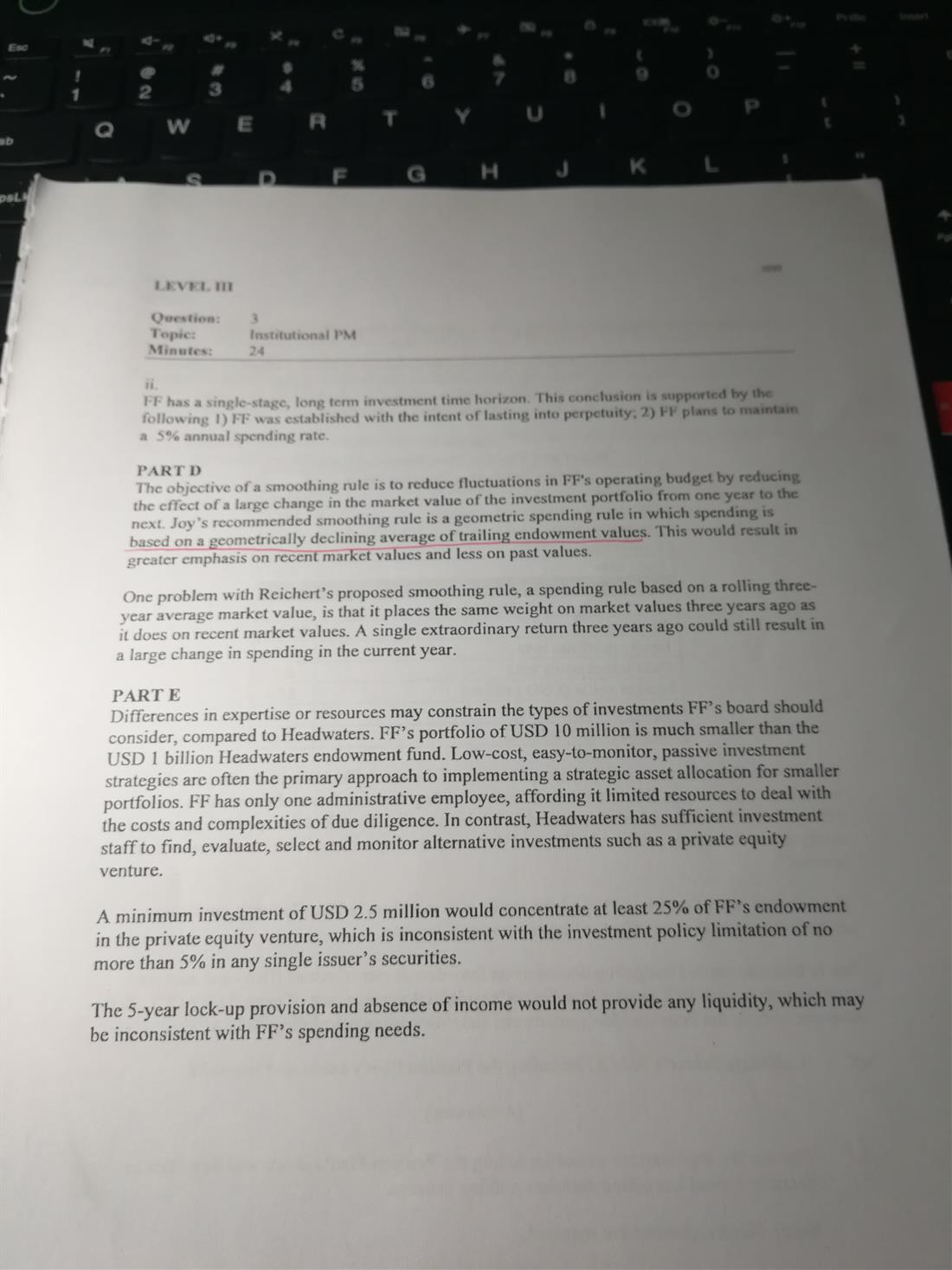

-

CFA三级

包含CFA三级传统在线课程相关提问答疑;

专场人数:1524提问数量:40740

精品问答

- Risk Budget and risk parity 第二道思考题,里面的Variance是不是完全是个冗余信息,给来误导的呀?

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 她对个人笔记本电脑(personal laptop)进行了完整备份(full backup),并确保备份前已删除所有公司文件(all company files removed)。 目的:确保新备份中不包含任何前公司数据,避免合规风险。 遗留问题: 硬盘上的旧备份(previous backups)仍包含公司文件。 她不想因删除旧备份而丢失个人文件的备份历史(backup history for personal files)。 针对上述分析我有个疑惑,这个人不是已经在自己笔记本上备份了drive上的个人信息吗,怎么又Not wanting to lose the backup history for her personal files呢?他不是已经把自己的私人信息备份了吗!?

- 老师第二题 假设激励费的费率都一样 是不是soft会比hard好很多对于GP来说 GP会赚多得多的钱?

- 第二题答案上说的是smaller difference,选项c是wider dispersion 是不是题出错了

- 2022 mock A上午部分,第4题的BC 两问,答案不怎么明白。

- 能否从定义出发解释下CDS price是什么?为什么要这样计算?它在实操中怎么用?

- 这道题约掉百分号我觉得是错误的,因为如果把百分号带入进去,实际结果比题目中的结果大100倍,原版书课后题P106页,我算出来答案是43287,可是结果是4317774,请问我可否说原版书出题不严谨?