-

CFA三级

包含CFA三级传统在线课程相关提问答疑;

专场人数:1525提问数量:40740

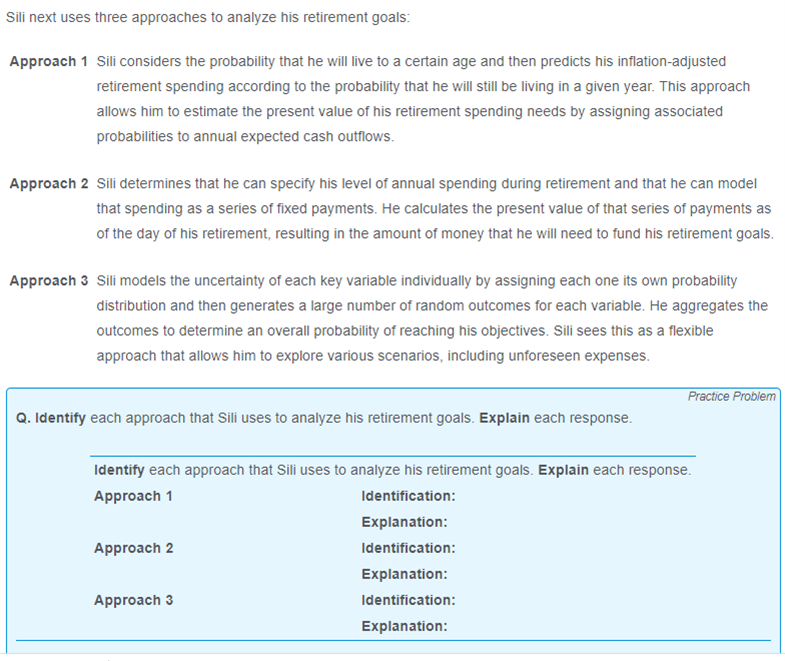

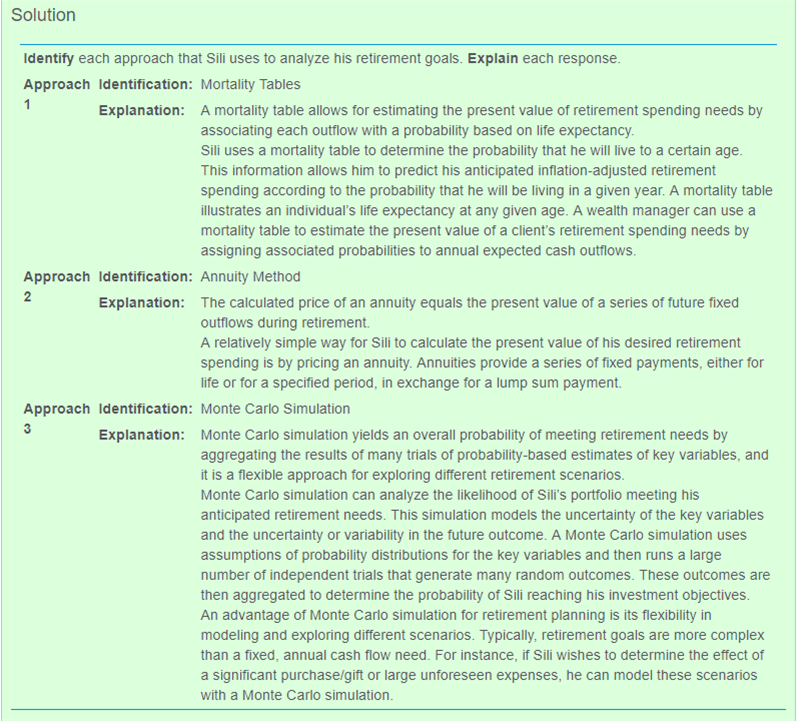

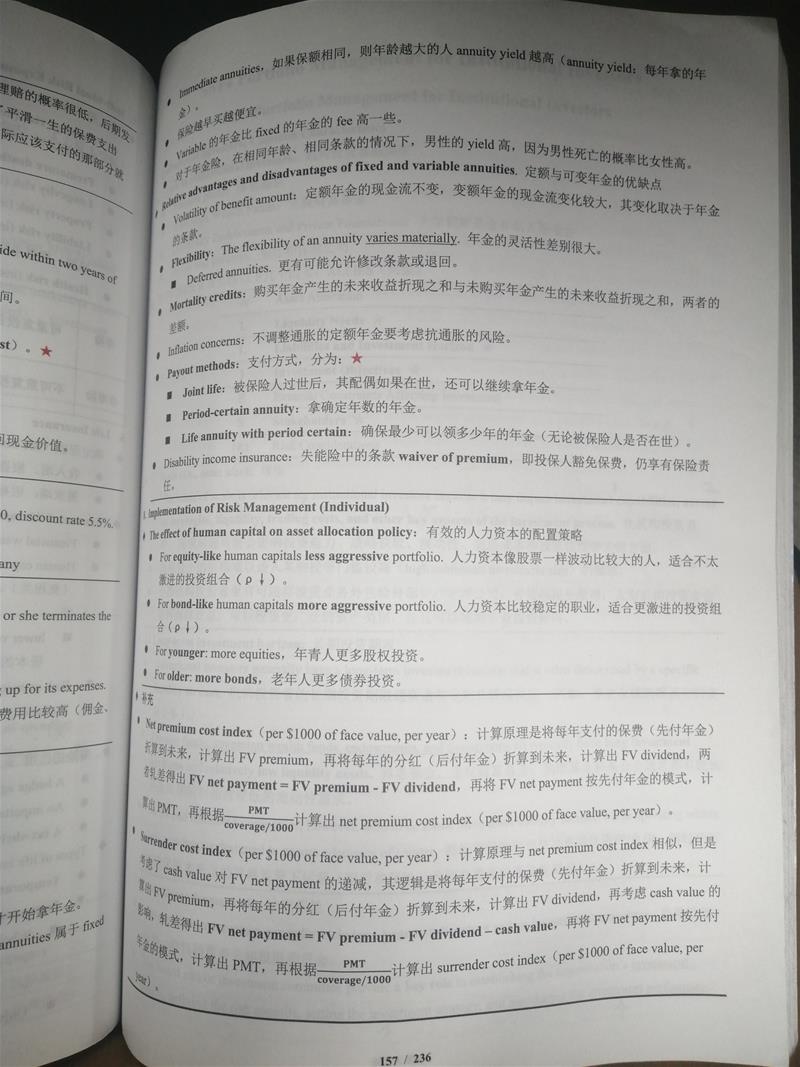

請問這題這樣寫是否足夠 Approach 1: the approach that Sili takes is mortality table. The mortality table approach is to take the probability of living and spending needs into account at the same time. According to the approach that sili used, he estimate the probability of living and the PV of retirement spending needs which matches the description of mortality table approach; Approach 2: the approach that Sili uses is annuity pricing. The pricing strategy is to estimate the expected spending need and derive the amount of capital needed. The approach Sili used is to estimate the PV of payments after the retirement, which matches the description of annuity pricing approach; Approach 3: the approach that Sili uses is Monte Carlo simulation. The simulation is to estimate the probability of distribution of possible results. The approach used by Sili is to models the uncertainty of each key variable individually by assigning each one its own probability distribution and obtains a large number of rand

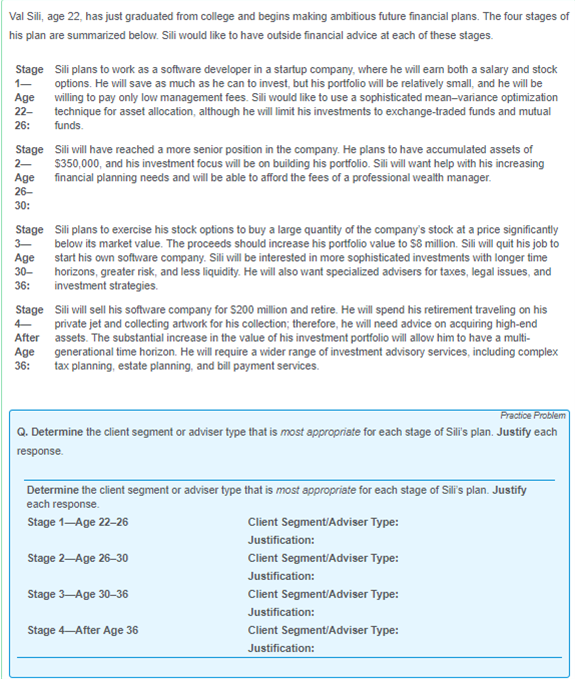

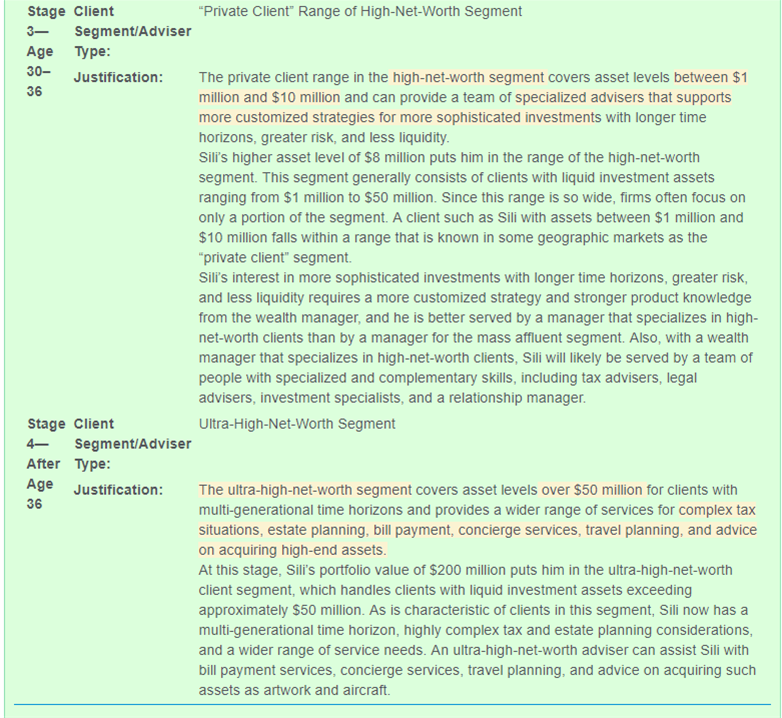

請問這題這樣寫是否足夠? Determine the client segment or adviser type that is most appropriate for each stage of Sili’s plan. Justify each response. 1. Stage 1: this stage belongs to robot-advisor. The client’s asset value is below $250,000 level and the client construct his portfolio with ETFs, Mutual funds, and low-cost alternatives; 2. Stage 2: this stage is a mass affluent segment. The client’s asset is between $250,000 to $1mn and the client starts having a need for financial plans; 3. Stage 3: this is stage is a high-net-worth client. The client’s asset is between $1mn to $10mn and the client has specific financial services; 4. Stage 4: this stage is ultra-high-net-worth. The client’s asset is above $50mn and the client has needs for highly customized financial services.

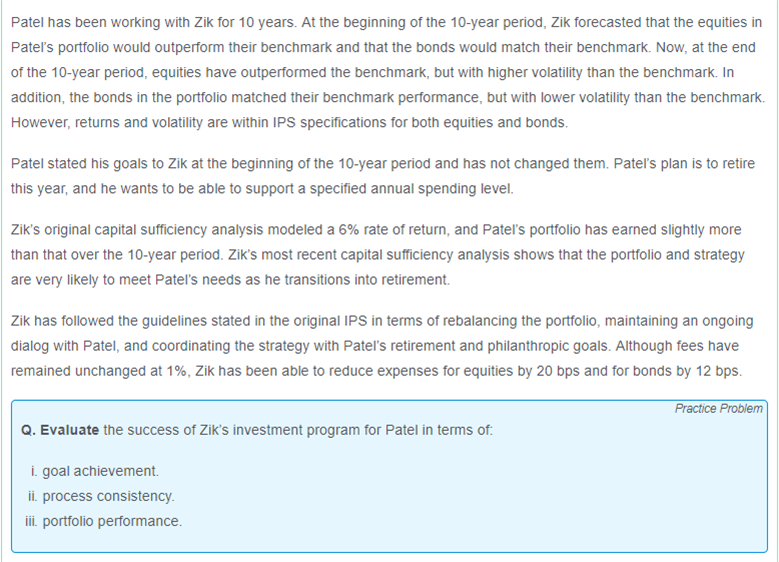

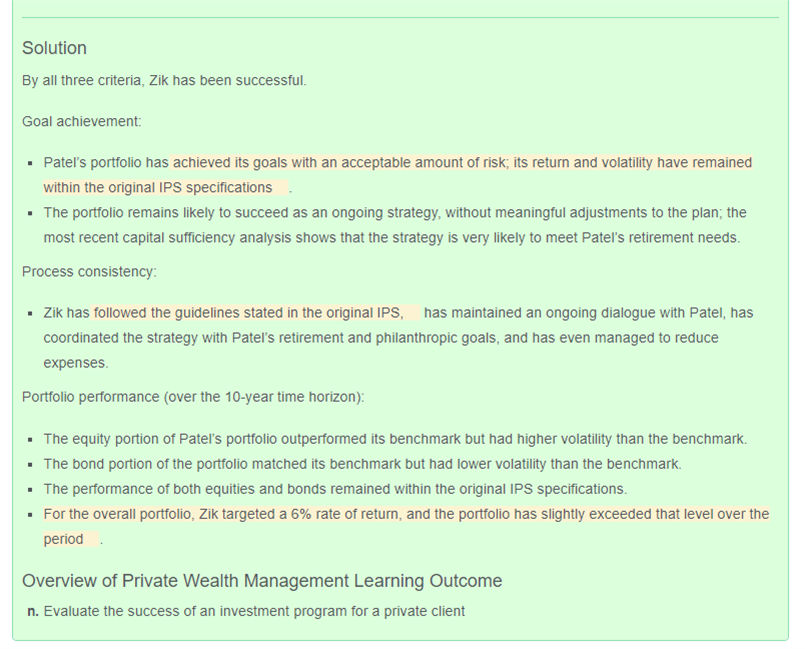

請問有關於這題goal achievement, process consistency, and portfolio performance 這樣寫可以嗎? goal achievement. 1. The manager is successful to achieve the goal because the portfolio achieved a better-than-expected return with an acceptable level of risk; 2. According the capital sufficiency analysis, the portfolio is likely to meet the client’s need. process consistency. 1. The portfolio has consistently delivered a desired result over the investment horizon, which suggests the manager achieved the goal based on the skills; 2. The manager followed the investment guideline stated in the IPS in terms of rebalancing the portfolio and communicating with the client. portfolio performance. 1. The portfolio delivered a better-than-expected result because the return is higher than the target and the expenses are reduced.

精品问答

- Risk Budget and risk parity 第二道思考题,里面的Variance是不是完全是个冗余信息,给来误导的呀?

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 她对个人笔记本电脑(personal laptop)进行了完整备份(full backup),并确保备份前已删除所有公司文件(all company files removed)。 目的:确保新备份中不包含任何前公司数据,避免合规风险。 遗留问题: 硬盘上的旧备份(previous backups)仍包含公司文件。 她不想因删除旧备份而丢失个人文件的备份历史(backup history for personal files)。 针对上述分析我有个疑惑,这个人不是已经在自己笔记本上备份了drive上的个人信息吗,怎么又Not wanting to lose the backup history for her personal files呢?他不是已经把自己的私人信息备份了吗!?

- 老师第二题 假设激励费的费率都一样 是不是soft会比hard好很多对于GP来说 GP会赚多得多的钱?

- 第二题答案上说的是smaller difference,选项c是wider dispersion 是不是题出错了

- 2022 mock A上午部分,第4题的BC 两问,答案不怎么明白。

- 能否从定义出发解释下CDS price是什么?为什么要这样计算?它在实操中怎么用?

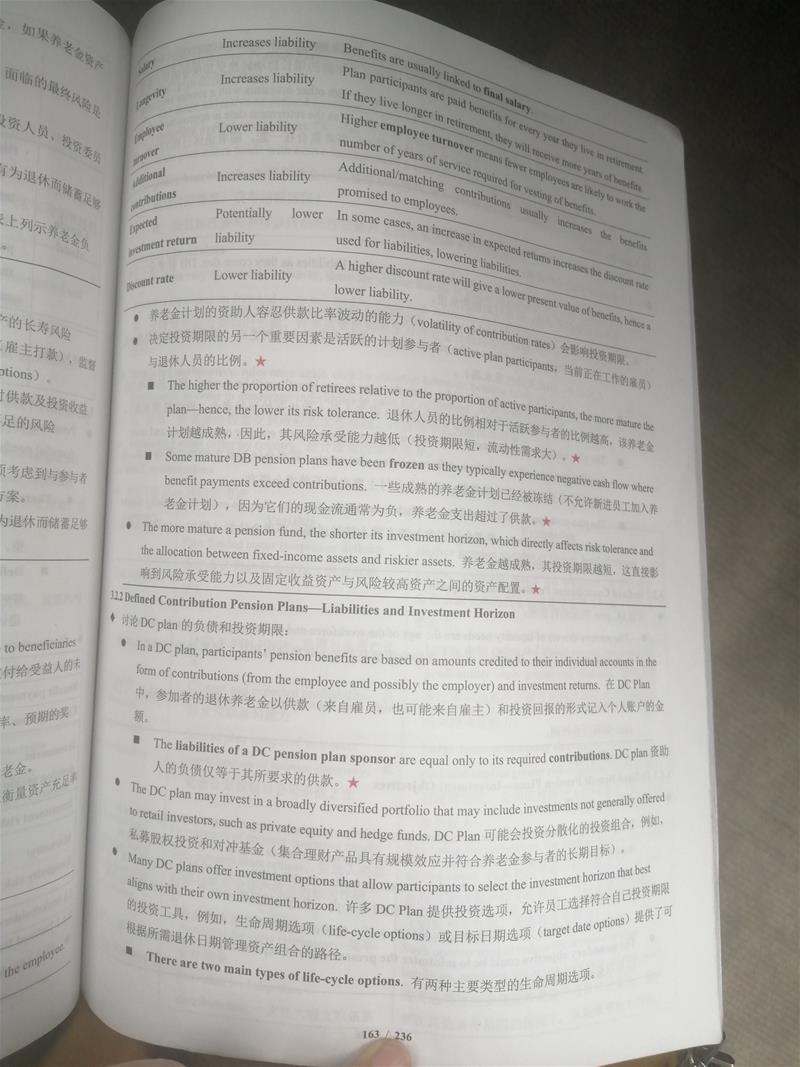

- 这道题约掉百分号我觉得是错误的,因为如果把百分号带入进去,实际结果比题目中的结果大100倍,原版书课后题P106页,我算出来答案是43287,可是结果是4317774,请问我可否说原版书出题不严谨?