-

CFA二级

包含CFA二级传统在线课程、通关课程及试题相关提问答疑;

专场人数:2450提问数量:55574

老师 我有两个问题: 1. 图二,我们算 zero-coupon bond 的IRR时是 used its fair value; 图三我们在算 coupon-paying bond 的IRR时用了他的 market value. 究竟是有 when there are both fair value and market value, we’ll always use market value over fair value, or is it for zero-coupon bond, we use fair value, and for coupon-paying bond, we use market value? 2. 图一, for zero-coupon bond, it is easy to get implied YTM and calculate credit spread, but what about for coupon-paying bond? How do we calculate the implied YTM? Can you please show me step by step? Thanks in advance.

精品问答

- Growth due to capital deepening 是αΔK/K还是ΔK/K

- 这题为什么是选C?

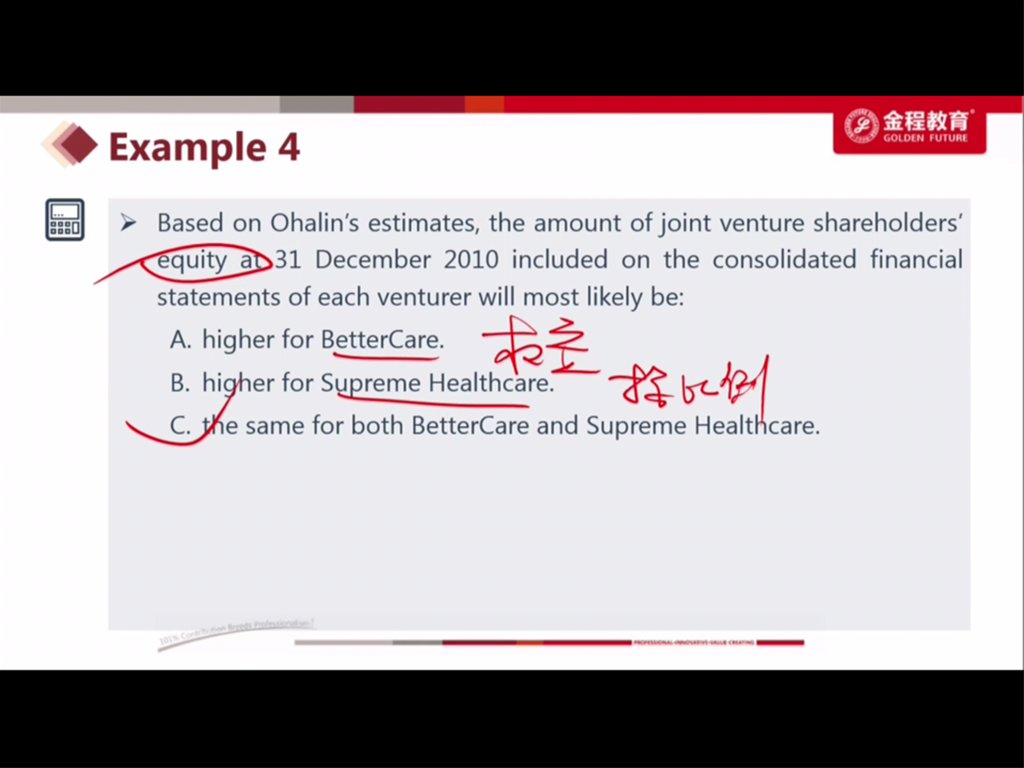

- 请老师讲解一下这个题目

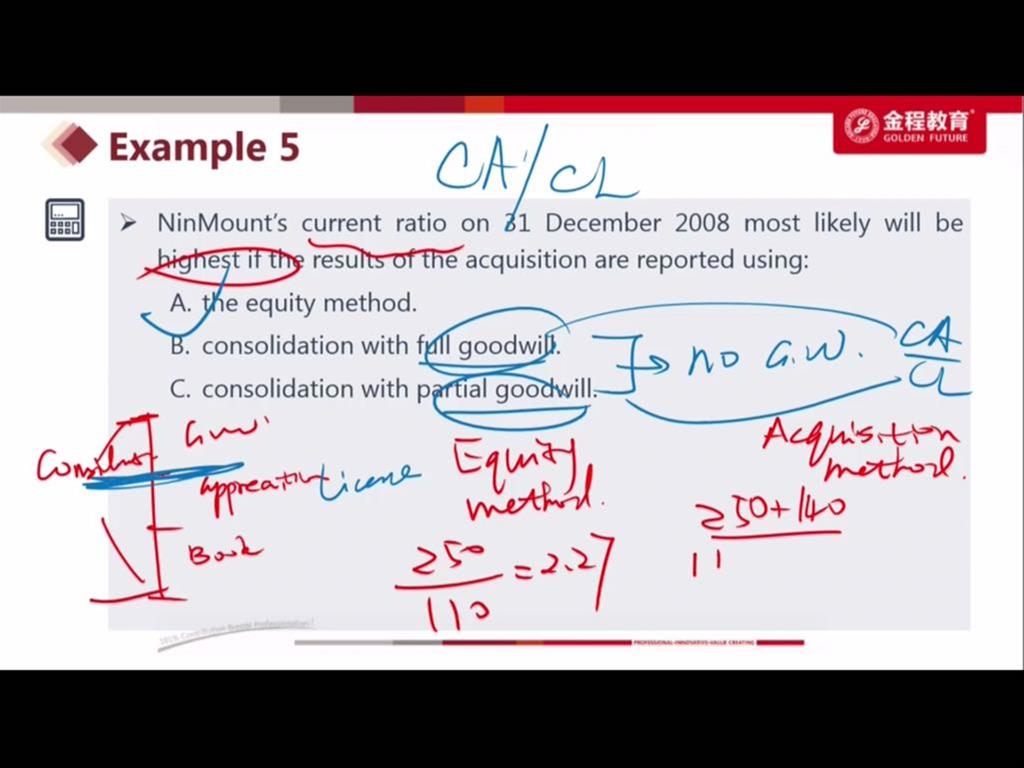

- 老师,第二题可以在解释一下原理吗?

- 老师,第三题答案的意思是:1.因为宽松的货币政策,导致加元利率下跌,导致加元贬值?2.但是,如果利率下跌,也就是分母上的百分比下降,不是会导致价格上升吗?。3.从而短期看是depreciation,但是长期来看,会回归到均值,所以是appreciation?

- CDS的long和short是不是反过来的?就是long CDS代表看涨目标公司credit,所以是卖出一份CDS合约?

- 很迷惑到底是long call+ short stock还是long stock+short call构建无风险资产

- 为啥accrued interest over contract life是0?