-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6068提问数量:109338

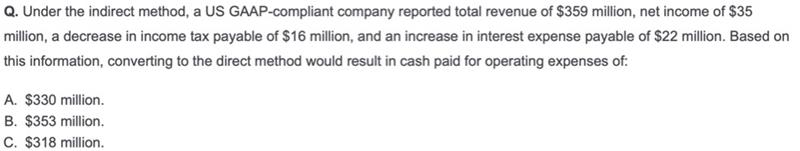

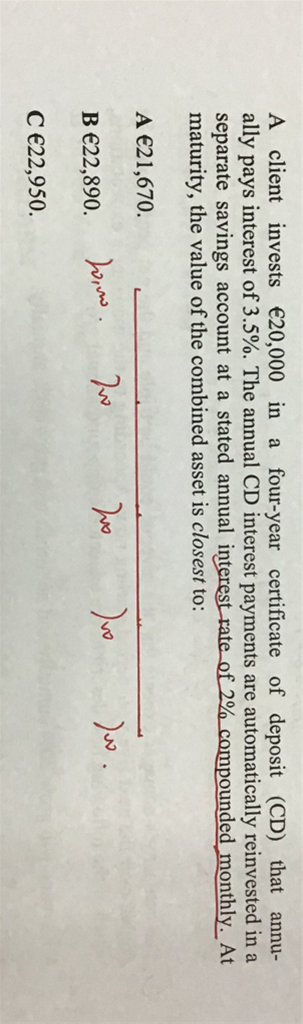

老师好!题目如下: As one moves to the right along an investor's EF, a set increase in risk is most likely to lead to: A. sequentially larger increases in expected return; B. consistent increases in expected return; C. sequentially smaller increases in expected return. 答案是C,麻烦老师讲解,谢谢!

已回答老师好!题目如下: Risk-averse investors who invest in risk-free assets will have a numerical utility that is: A. same as risk-seeking averse; B. higher than risk-averse investor; C. higher than risk-neutral investor; 答案是A,麻烦老师讲解,谢谢!

已回答老师好!题目如下: Relative to an investor with a steeper indifference curve, the optimal portfolio for an investor with a flatter indifference curve will most likely have: A. a lower level of risk and return; B. a higher level of risk and return; C. the same level of risk and return 答案是B,麻烦老师讲解,谢谢!

已回答老师好!题目如下: The return measure that best allows one to compare asset returns earned over different length time period is the: A. Annualized return B. net Portfolio return C. holding period return 答案是A 麻烦老师讲解,谢谢!

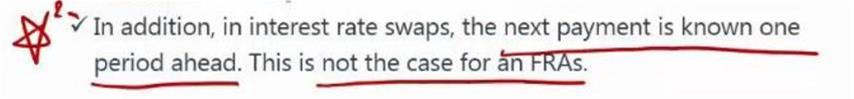

已回答Swap的下一期payment可以提前一期知晓: 1.不知下一期payment,具体指什么?假如浮动换固定,我理解固定是掉期率,是已知的,下一期payment,是不是指下一期浮动利率? 2.如果是下一期浮动利率,不知是怎么算出来的? 谢谢!

精品问答

- 为什么半年付息 算ytm是乘以2 而年化的麦考利久期是除以2

- 为什么长期垄断竞争中 D和ATC相切

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 为什么可以把TR TC同时体现在纵轴?

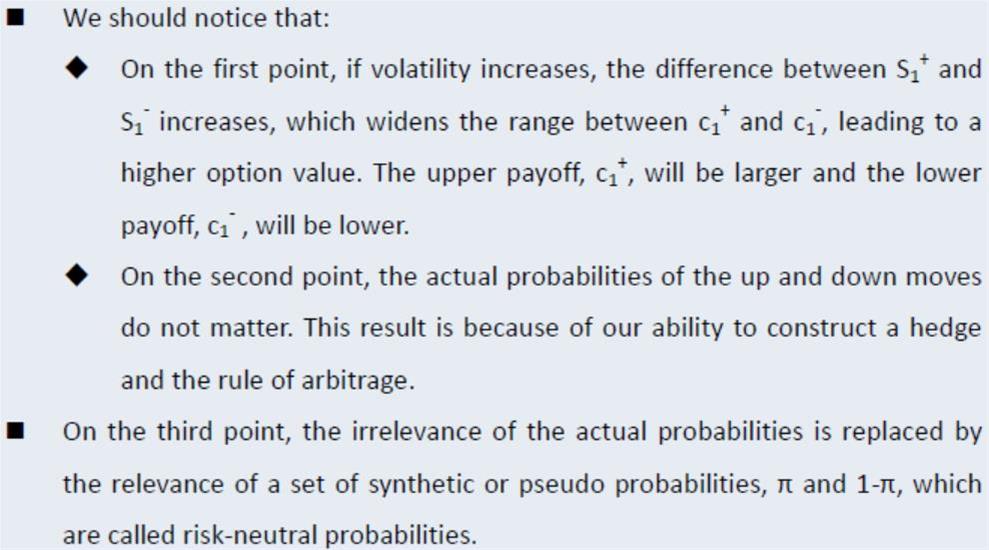

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?