-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6068提问数量:109338

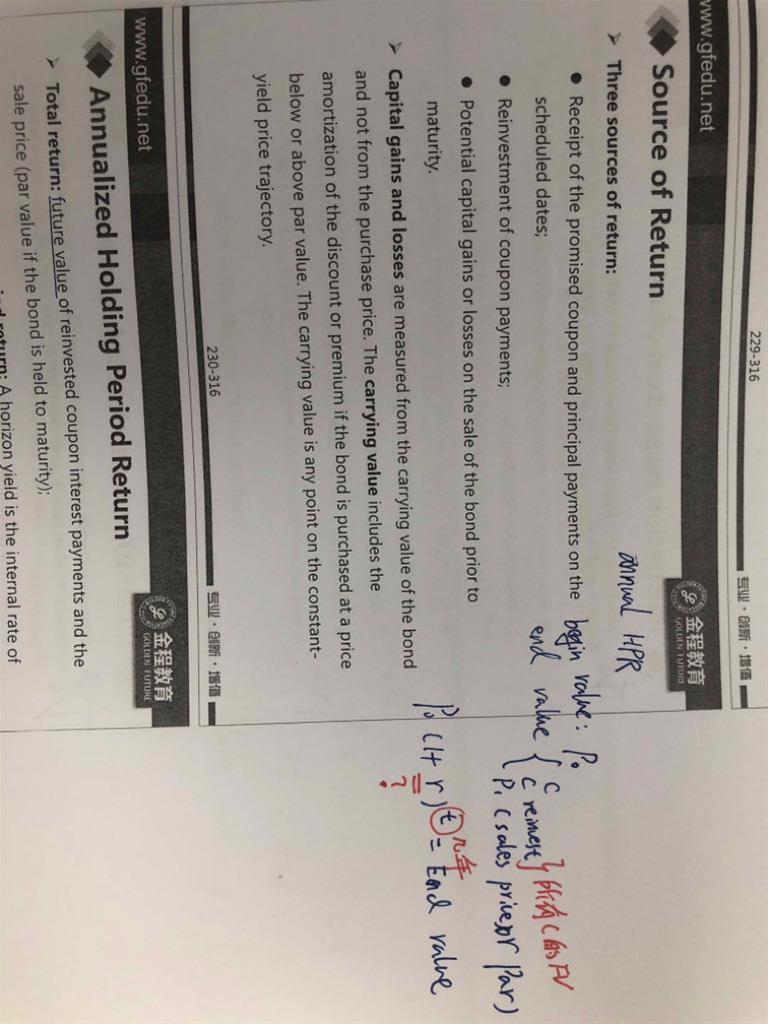

Holding period return来自于三方面分别是coupon coupon reinvest以及principle 可是实际上固定收益的收益是固定了的 这个coupon reinvest是如何体现的呢? 我的意思是 实际上在一只债券的一生中就实际支付了coupon和principle 邪恶coupon reinvest体现在哪里

07.单选题 已收藏 标记 纠错 Kate Kally, CFA, manages several hundred employees as the head of research for a large investment advisory firm. Kate, as a former securities regulatory official until recently, ensured that his department’s compliance program always met or exceeded those of its competitors. Kate has delegated his supervisory responsibilities concerning compliance issues to Sucy Chen. Kate informed Sucy that her responsibilities include ensuring that the firm has appropriate compliance procedures and is making reasonable efforts to detect and prevent violations of Rules, Regulations, and the Code and Standards. Kate most likely violated the CFA Institute Standards of Professional Conduct by not telling Sucy to consider: A Firm policies. B Industry standards. C Legal restrictions. 这题选A,好像两个答案有冲突?

查看试题 已回答精品问答

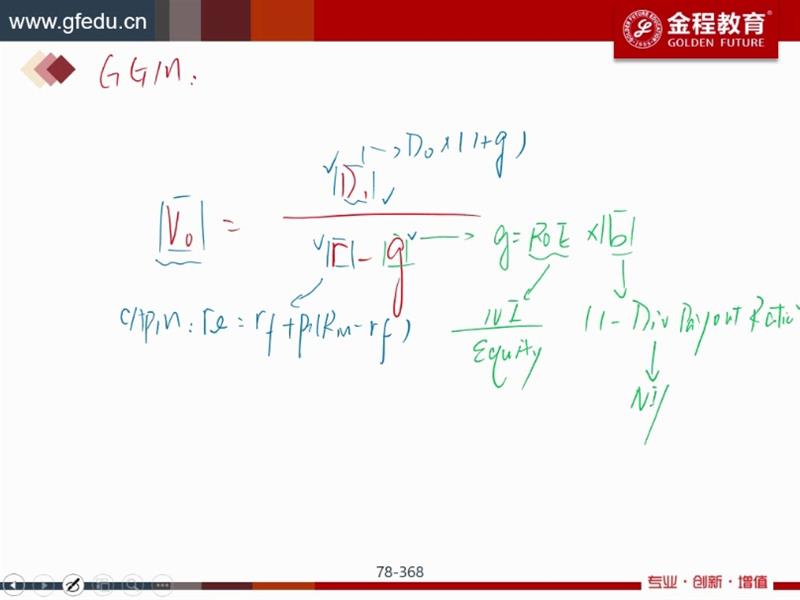

- 为什么半年付息 算ytm是乘以2 而年化的麦考利久期是除以2

- 为什么长期垄断竞争中 D和ATC相切

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 为什么可以把TR TC同时体现在纵轴?

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?