-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6052提问数量:108963

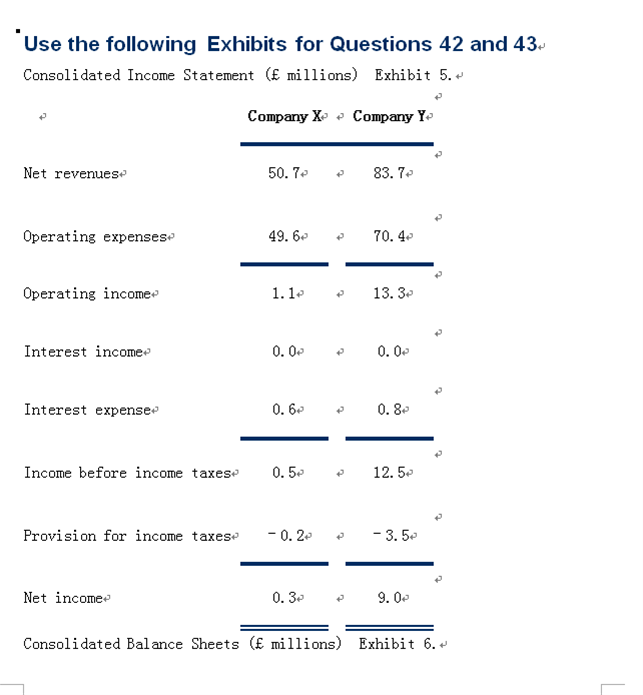

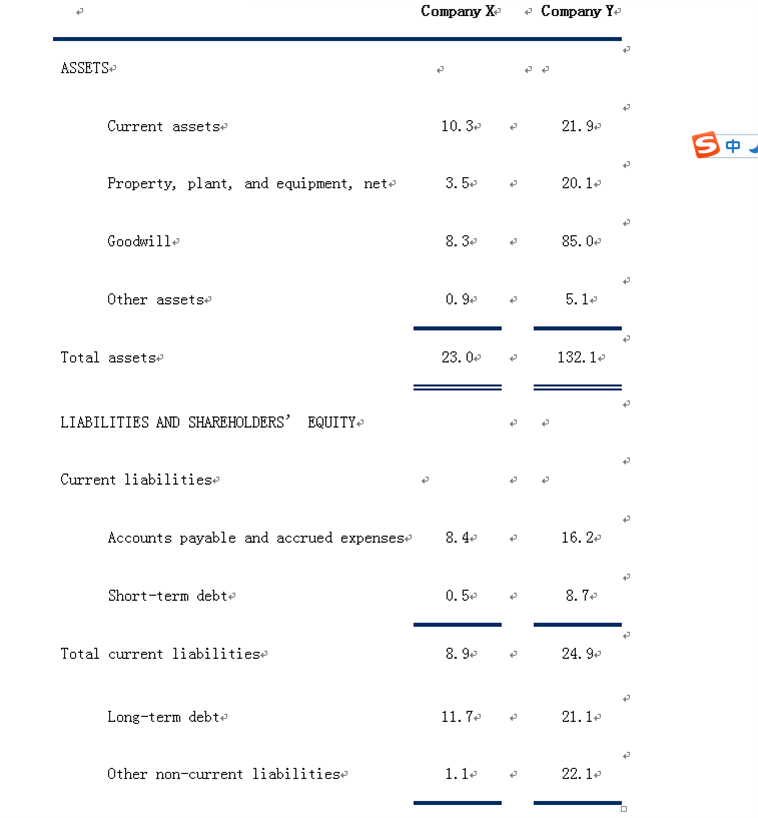

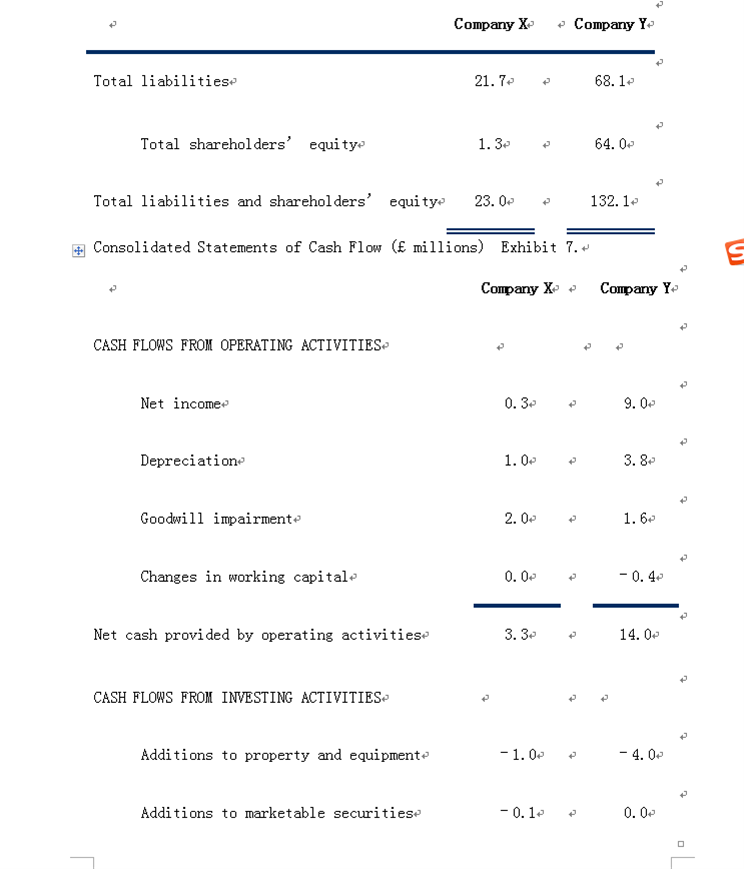

42. Based on Exhibits 5–7, in comparison to Company X, Company Y has a higher: A. debt/capital ratio. B. debt/EBITDA ratio. C. free cash flow after dividends/debt ratio. 选A。 C is correct because Company Y has a higher ratio of free cash flow after dividends to debt than Company X, not lower, as shown in the following table. Free cash flow after dividends as a % of debt = FCF after dividends Debt Company X Company Y Cash flow from operations £3.3 £14.0 Less Net capital expenditures –0.8 –1.1 ?? Dividends –0.3 –6.1 Free cash flow after dividends £2.2 £6.8 固收课后题reading 55 第42题,答案讲解中,在计算自由现金流时,这个值:Net capital expenditures –0.8 –1.1 ??,是如何求出来的,没看懂。麻烦老师讲解一下。谢谢。

你好,关于债券-零息债券,网课里24-235,24-236这里,老师说到,资本利得税,债券在到期之前,提早卖掉,有价差,就要缴纳资本利得税,那实际里面也有,为了现金周转,提早便宜卖掉或转让,甚至亏本,这样是不是可以不要交税了?也没有获利。

已回答For NARU and NAIRU, which of the following is not a problem? A They may change over time given changes in technology and economic structure. B They do not account for bottlenecks in segments of the labor market (e.g., college graduates). C They only work in monetarist models. 这题怎么没听说过?啥是naru,nairu?

查看试题 已回答A market structure with relatively few sellers of a homogeneous or standardized product is best described as: A oligopoly. B monopoly. C perfect competition. 这题答案错了吧,很明显是垄断,比如移动,联通,少厂商,同质化产品

查看试题 已回答精品问答

- m上升 EAR为什么上升 以及为什么又不变

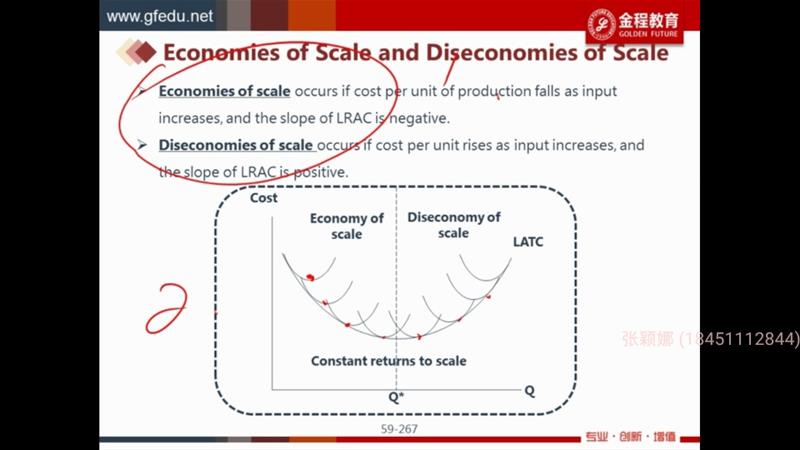

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 为什么可以把TR TC同时体现在纵轴?

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?

- 不懂这里为什么新固定利息与老固定利息的差值折现到1时刻就是1时刻的value,为什么只考虑下半边支出的部分,不考虑付息收到的部分

- 老师好,官网这道题我有点没太懂,麻烦讲解