紫同学2018-04-01 09:59:35

紫同学2018-04-01 09:59:35

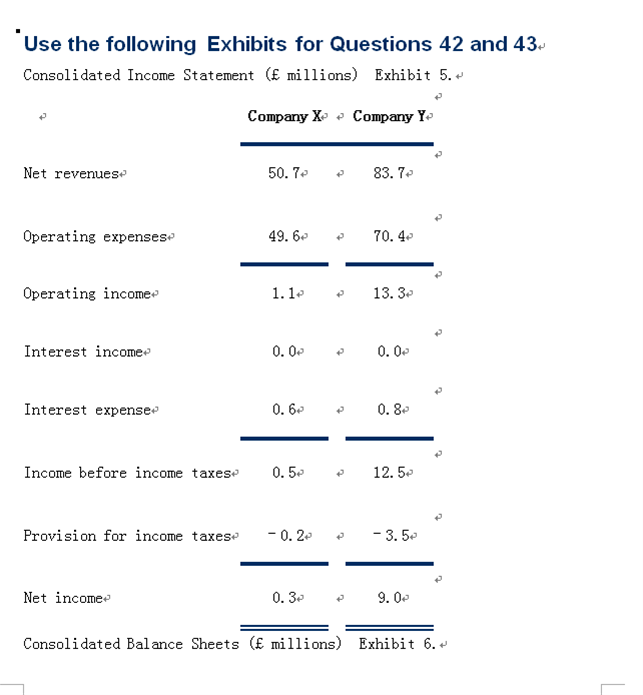

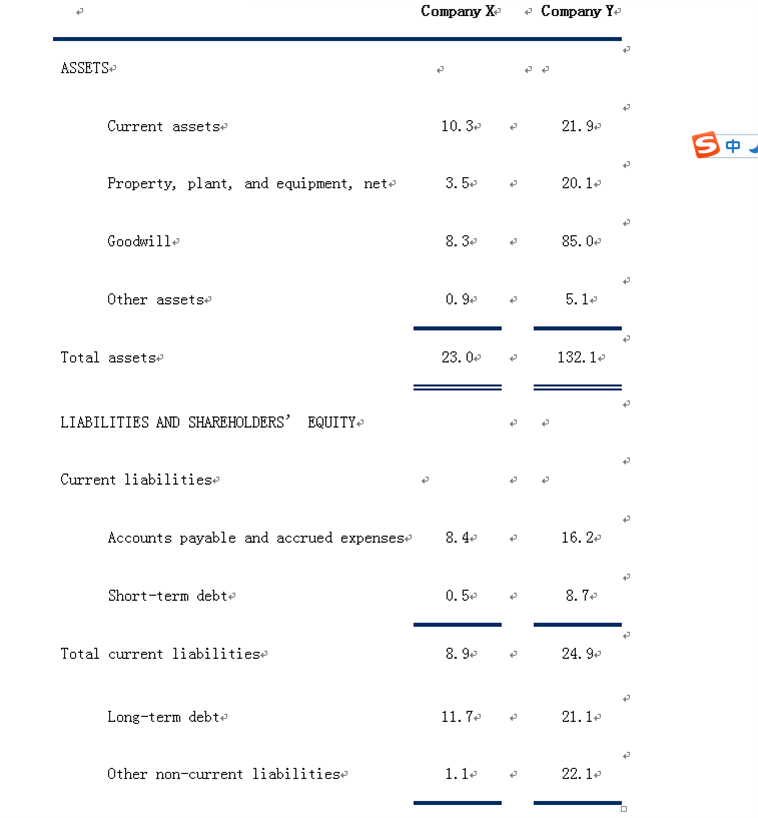

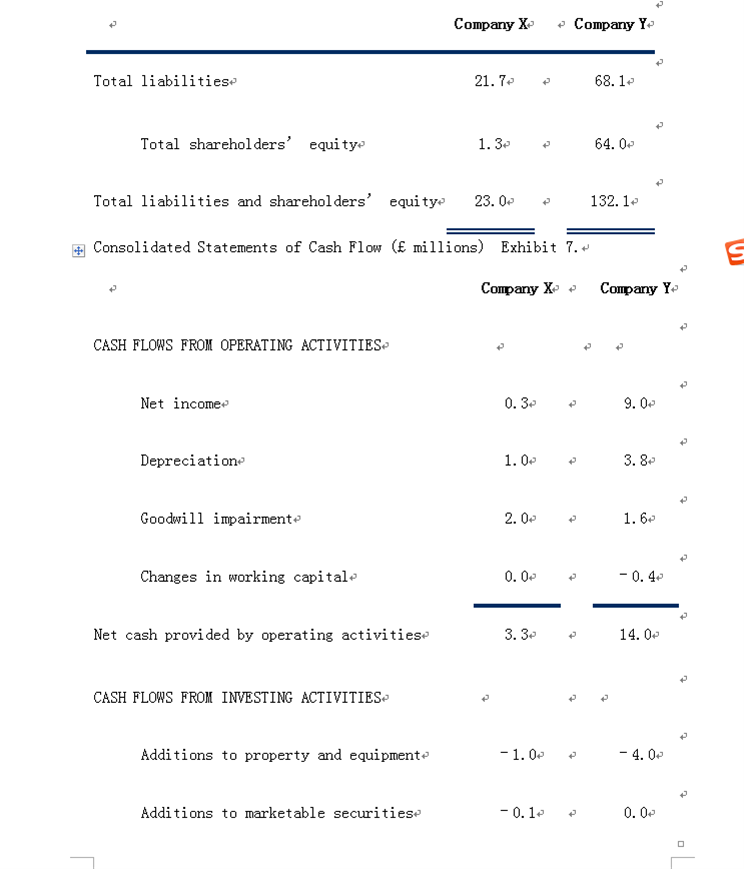

42. Based on Exhibits 5–7, in comparison to Company X, Company Y has a higher: A. debt/capital ratio. B. debt/EBITDA ratio. C. free cash flow after dividends/debt ratio. 选A。 C is correct because Company Y has a higher ratio of free cash flow after dividends to debt than Company X, not lower, as shown in the following table. Free cash flow after dividends as a % of debt = FCF after dividends Debt Company X Company Y Cash flow from operations £3.3 £14.0 Less Net capital expenditures –0.8 –1.1 ?? Dividends –0.3 –6.1 Free cash flow after dividends £2.2 £6.8 固收课后题reading 55 第42题,答案讲解中,在计算自由现金流时,这个值:Net capital expenditures –0.8 –1.1 ??,是如何求出来的,没看懂。麻烦老师讲解一下。谢谢。

回答(1)

Paul2018-04-02 10:32:32

Paul2018-04-02 10:32:32

同学你好,这个net capital expenditure是由Exhibit 7得出的,计算的是固定资产的投入additions to property and equipment和固定资产卖出的差值,proceeds from sale of----。

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片