-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6053提问数量:108978

If there is more underperformance for the portfolio, the shape of the portfolio’s return compared to the normal distribution is: A Leptokurtic B Platykurtic C Mesokurtic 这题什么原理呢?说这个组合表现不好,是怎么不好?是涨幅小还是波动大也没说,return区间也没说,怎么取夏普来看呢?

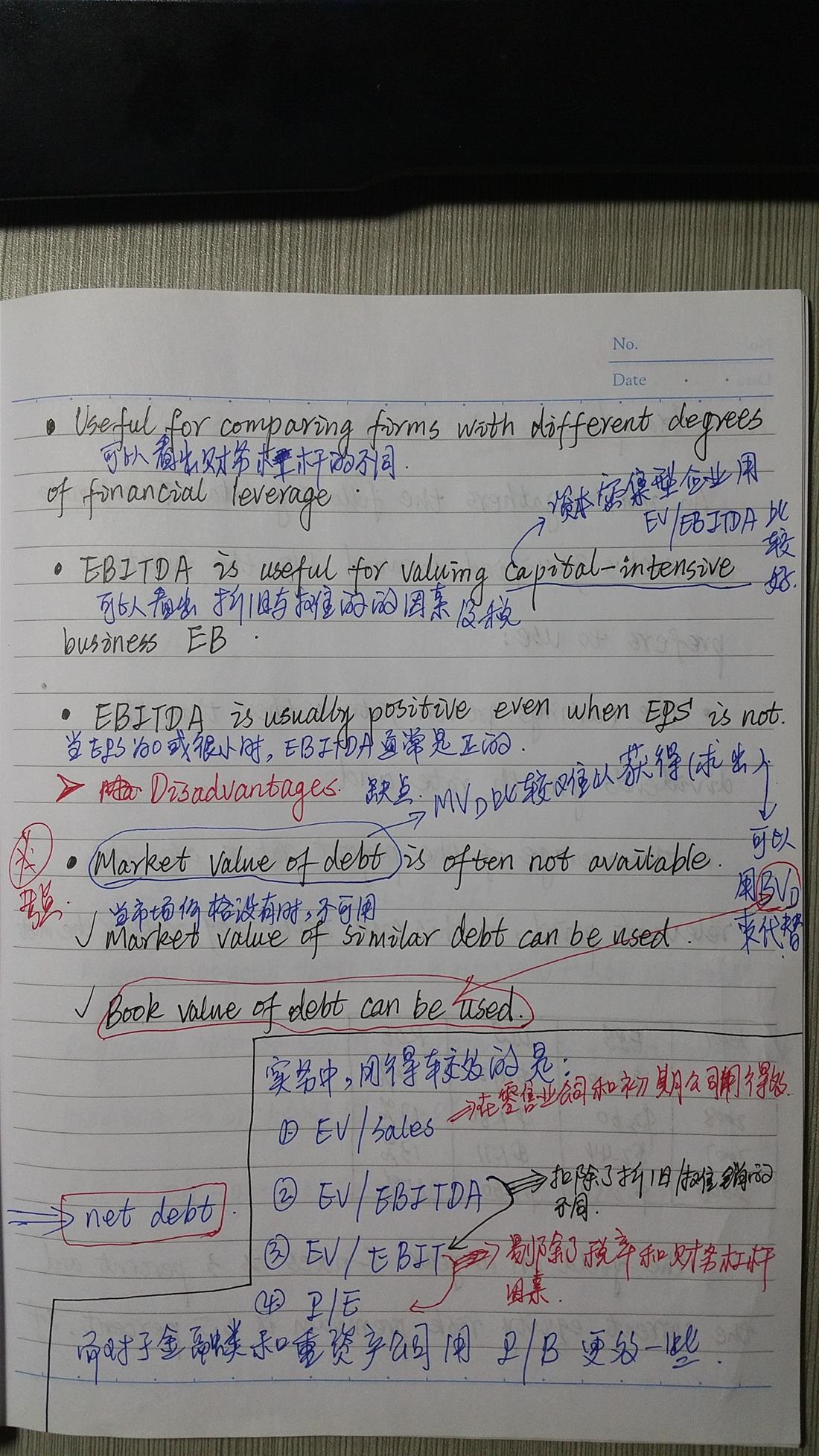

查看试题 已回答29. Which of the following statements regarding the calculation of the enterprise value multiple is most likely correct? A. Operating income may be used instead of EBITDA. B. EBITDA may not be used if company earnings are negative. C. Book value of debt may be used instead of market value of debt. A is correct. Operating income may be used in place of EBITDA when calculating the enterprise value multiple. EBITDA may be used when company earnings are negative because EBITDA is usually positive. The book value of debt cannot be used in place of market value of debt. 老师,问一下,这道课后题答案说:The book value of debt cannot be used in place of market value of debt. 也就是说MVd不能用BVd来代替,然而,纪老师和***老师讲课时,都说可以的,而且金程课件也写了可以用BVd来代替。到底是能不能被BVd来代替啊?

Dimitry Kha, CFA, examines the following information: The 6-month forward rate 1 year from now is closest to: A 4.70%. B 4.75%. C 4.80%. 这个题是什么原理呢?错了好几遍了也没记住

查看试题 已回答Which of the following regulations will most likely contribute to market efficiency? Regulatory restrictions on: A Short selling. B Foreign traders. C Insiders trading with nonpublic information. 这题明显选a呀,答案错了吧?

查看试题 已回答What is the reason that an investor may prefer a single hedge fund to a fund of funds? A He seeks due diligence expertise. B He seeks better redemption terms. C He seeks a less complex fee structure. 这题答案错了吧,说选c,应该选b才对,单一对冲基金的fof手续费更贵,怎么会有人选呢?b的话会求一个更好的赎回期限

查看试题 已回答精品问答

- m上升 EAR为什么上升 以及为什么又不变

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 不懂这里为什么新固定利息与老固定利息的差值折现到1时刻就是1时刻的value,为什么只考虑下半边支出的部分,不考虑付息收到的部分

- 如果IC和CAL线的切点在后半段呢,就是比和有效前沿的切点更高呢,不是后面无风险资产权重为0吗,为什么说一定有无风险资产呢

- 为什么不是C选项呢?credit risk是由于借款人违约未能偿还而使债权人遭受损失的风险;solvency risk是由于自己财务状况不佳而无法偿还到期债务的风险。二者紧密相连

- 那么股票的公允价值是不是交易价格? 既不和市场价值一样,也不和账面价值一样?

- 场内和场外OTC市场 与 公募和私募 是一样的吗? 那么一级市场和二级市场是不是都有场内和场外一说?