-

CFA问答

CFA问答包含CFA在线课程、CFA通关课程、CFA试题等所有CFA相关问题,每个问题老师均会在24小时内给出答疑回复哦!

专场人数:0提问数量:0

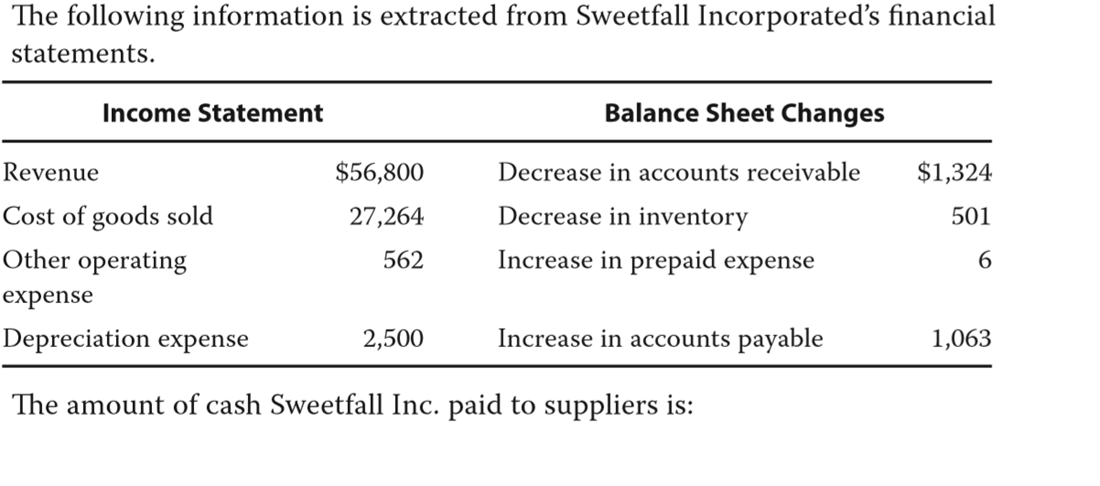

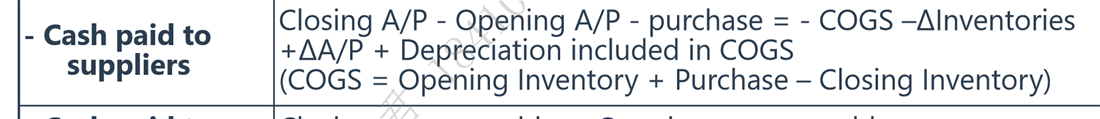

题目答案公式: Cost of goods sold – Decrease in inventory – Increase in accounts payable 。与讲义中cash paid to suppliers公式不一致,为什么?

经济学--2019教材--247页第7题: 本题的答案不也很荒唐吗??既然是经济周期,在衰退的时候,为何要折价卖掉呢,等到底谷,不就迎来反弹了吗??C选项可不可以理解成不再维修保养,因为这样也要成本开销,而是放置在那里,等经济复苏的时候,打扫干净加加油,就可以继续使用了。maintenance,如此理解符合CFA的观点吗??还是说非得不再持有即处置掉??

查看试题 已解决精品问答

- 为什么半年付息 算ytm是乘以2 而年化的麦考利久期是除以2

- 为什么长期垄断竞争中 D和ATC相切

- Growth due to capital deepening 是αΔK/K还是ΔK/K

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 老师,给最新的信息更高权重为什么不是availability bias呢?

- 第5题,从经济学公式X-M=(S-I)+(T-G)来看,如果经常账户赤字增加,不是意味着该国投资大于储蓄,或政府支出大于税收么,那么整体环境应该是好的,应该有利于资本的流入吧?为什么答案是反过来去赤字减少或盈余的国家呢?