-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6057提问数量:109067

Which of the following will lead Inventories to rise? A inventory—sales ratios are high. B economic activity begins to rebound. C inventory—sales ratios are low. 这题什么原理?

查看试题 已回答ABC Company sells computer parts by mail. A sample of 25 recent orders showed the mean time taken to ship out these orders was 45 hours with a sample standard deviation of 12 hours. Assuming the population is normally distributed, the 99% confidence interval for the population mean is: A 45 ± 2.80 hours. B 45 ± 6.98 hours. C 45 ± 6.71 hours. 是不是得有表才能做?2.797是怎么来的?

查看试题 已回答Using historical data that was not publicly available at the time period being studied will have a sample with: A Look-ahead bias. B Sample selection bias C Data-mining bias. 这题答案对吗?不应该是前视偏差吧,他确实用的历史数据,只是不公开,能举几个具体例子吗?老师课上讲的范围很大,

查看试题 已回答A sample of 100 observations drawn from a normally distributed population has a sample mean of 12 and a sample standard deviation of 4. Using the extract from the z-distribution given below, find the 95% confidence interval for the population mean. The 95% confidence interval is closest to: A 7.840 to 27.683 B 11.216 to 12.784 C 11.340 to 12.660 什么时候用12+1.96*4,什么时候用12+1.96*4/100根号下呢?

查看试题 已回答精品问答

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 为什么可以把TR TC同时体现在纵轴?

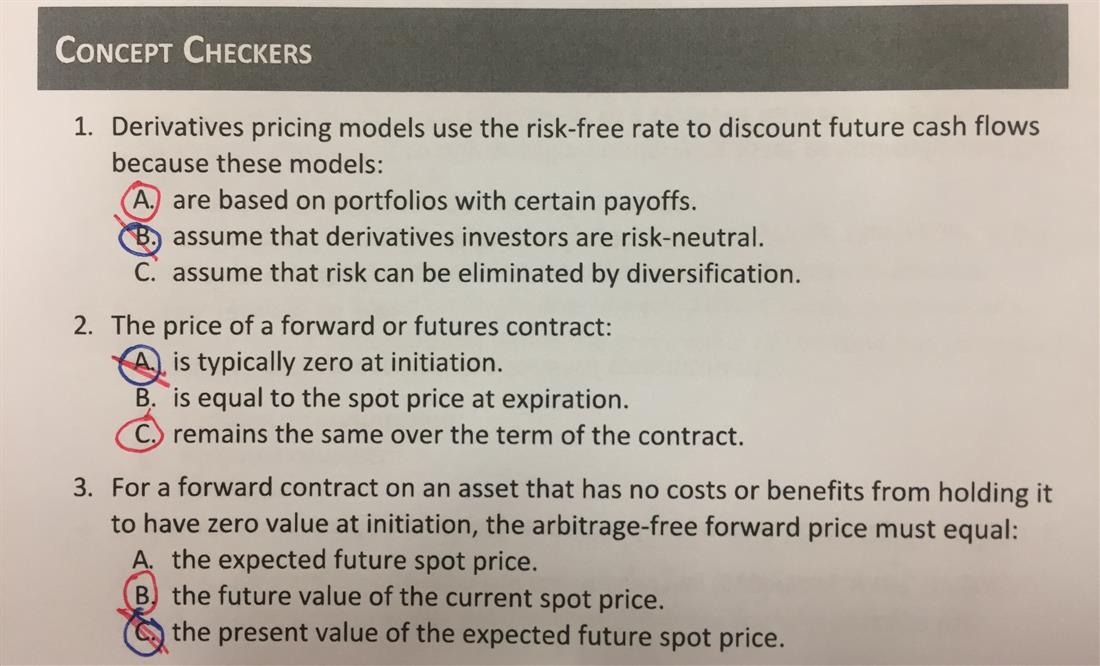

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?

- 不懂这里为什么新固定利息与老固定利息的差值折现到1时刻就是1时刻的value,为什么只考虑下半边支出的部分,不考虑付息收到的部分

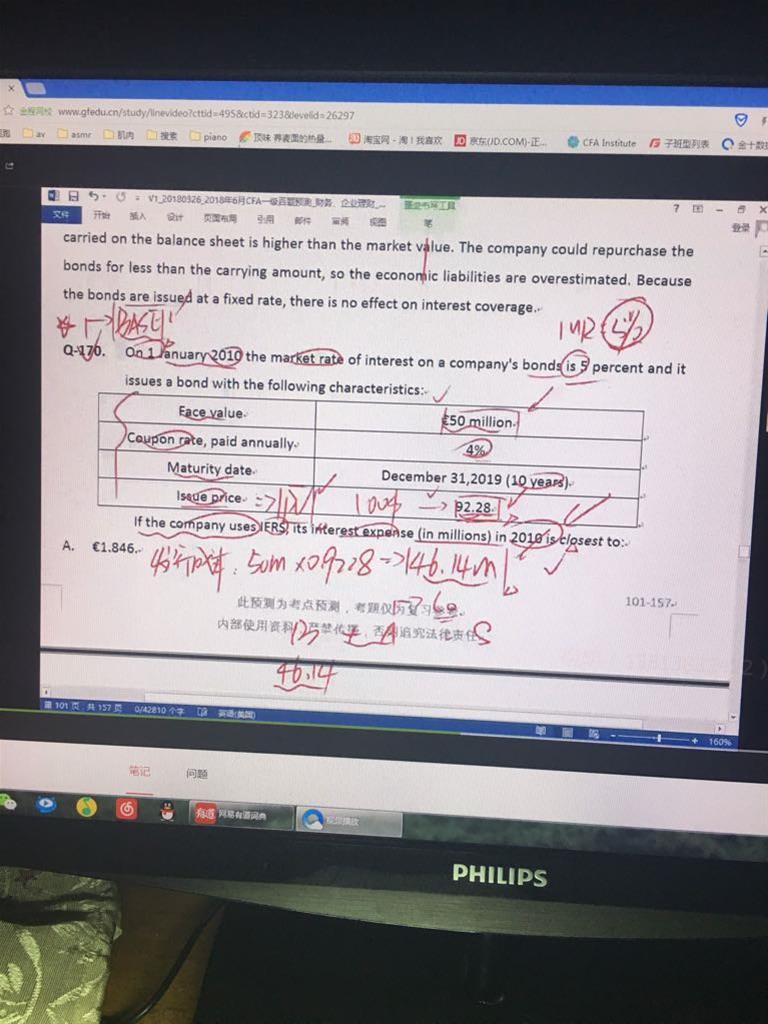

- 老师好,官网这道题我有点没太懂,麻烦讲解