MR.K2023-09-26 14:32:18

MR.K2023-09-26 14:32:18

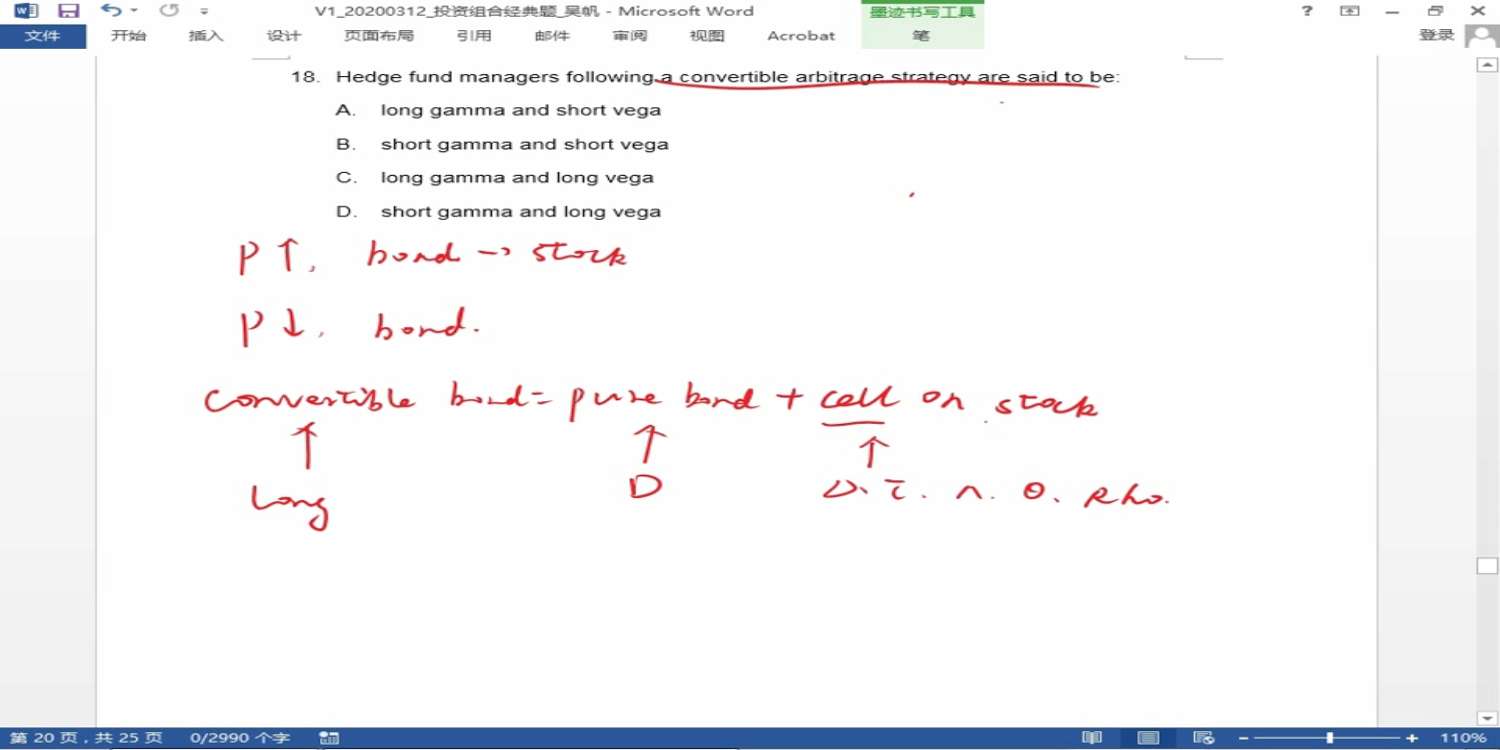

这个18题老师的讲解和标准答案差别太大了。标准答案是说shorting stock using delta headge ratio. because they are exposed to changes in the hedge ratio, they are said to be long gamma. They are also exposed to changes in the price volatility of the stock underlying the option embedded, so they are said to be long vega老师能解释一下这个标准答案是什么意思么。

回答(1)

最佳

苏学科2023-09-26 16:54:09

苏学科2023-09-26 16:54:09

同学你好,这部分你可以看讲义理解。long convertible 本质就是long 了风险因子,这些风险因子中部分可以通过short手段进行对冲(对于duration,delta可以对冲至中性分别通过short treasury and short stock(解析中的shorting stock by using delta hedge ratio,就是说用stock short的手段,对冲delta这一风险因子至中性;这时我们就剩下gamma 和vaga因子了,通过这两个风险因子进行套利)),因此说这个策略也叫net long gamma and vega strategy

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片