kathy sham2020-10-13 18:04:11

kathy sham2020-10-13 18:04:11

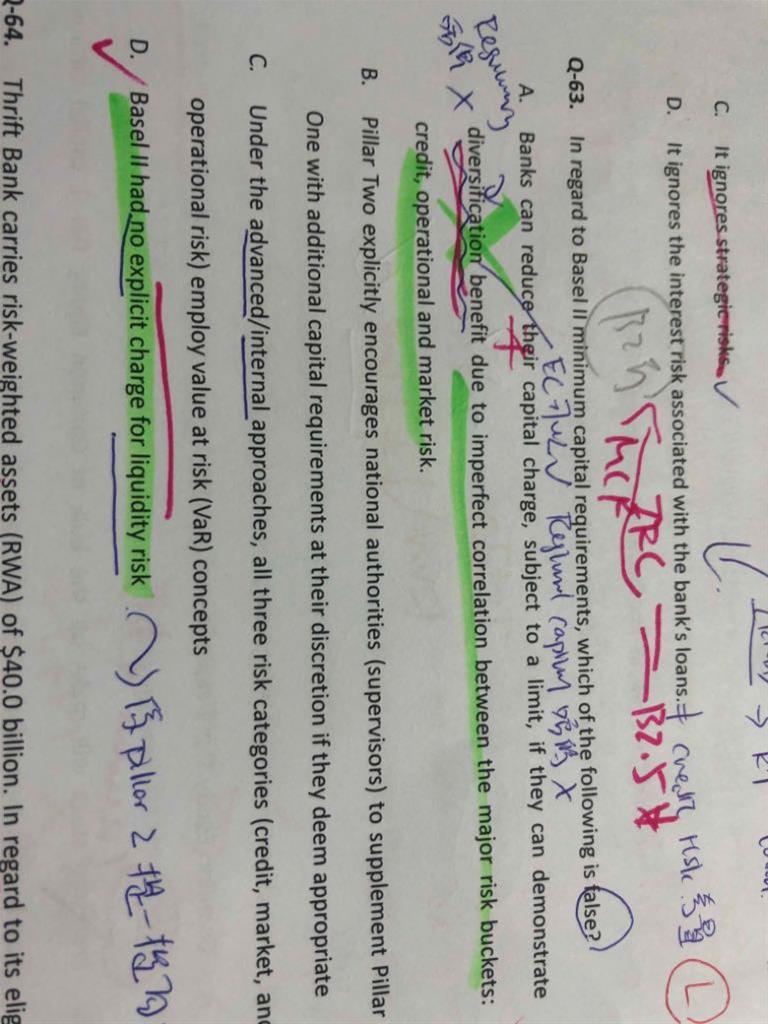

Q63 a assume correlation =1 and no diversification benefit. How ever when we measure market risk charge on standard approach for Basel one , we assumed correlation =0 for each asset type With no diversification, why is that?

回答(1)

Jenny2020-10-14 15:56:37

Jenny2020-10-14 15:56:37

同学你好,

在用标准法计量市场风险时,是将交易账户分为5大类,分别对交易账户中的每个项目提出了资本要求再加总。因此忽略了资产之间的相关性的分散作用,极端点说是不考虑分散性,所以correlation是1不是0.

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片