鸡同学2024-07-15 04:57:44

鸡同学2024-07-15 04:57:44

2022B下午case10。这题要如何理解?

回答(1)

最佳

Simon2024-07-17 16:14:20

Simon2024-07-17 16:14:20

同学,下午好。

1. 目前处在recovery阶段,“Yeti explains that he expects the recent economic recovery will reverse with weakening consumer spending”,这段换可以看出,我们目前是 recovery。

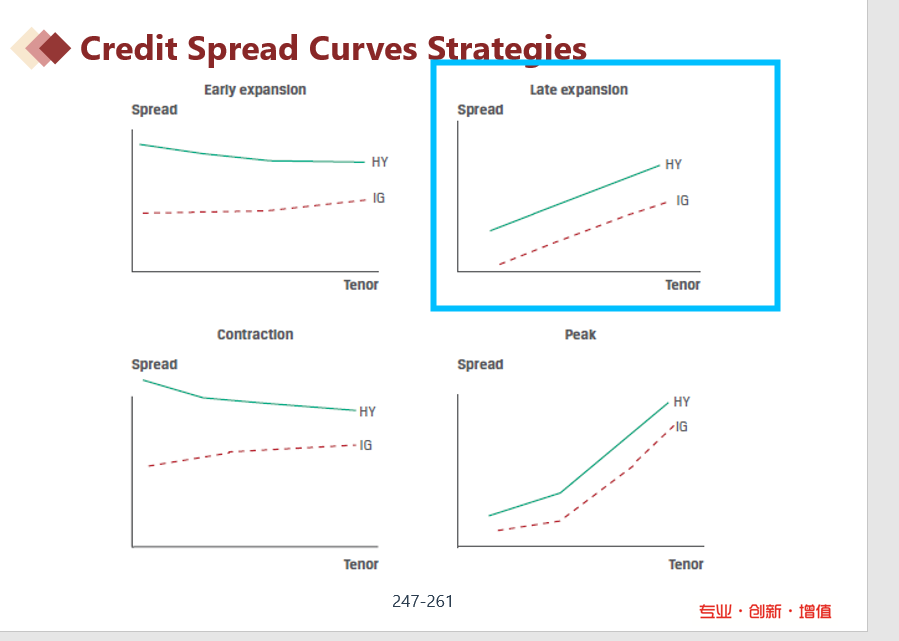

2. 第二个背景,Given the forecast of a potential turn in the credit cycle, Nucor is concerned about the relative performance of his accounts. 所以Nucor认为未来credit curve会斜向上(见截图),Nucor的策略是卖30年债,买5年债。完全合理。(未来长期spread上涨,长期债下跌,卖出)

3. 但是Smith不同意,认为Nucor会亏钱。B选项给的理由是credit curve会反转,如果反转,就是信用曲线就是斜向下,短期spread上涨,长期spread下跌,短期债会下跌,长期债会上涨,Nucor的策略会亏钱。

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片