穆同学2024-05-01 09:30:26

穆同学2024-05-01 09:30:26

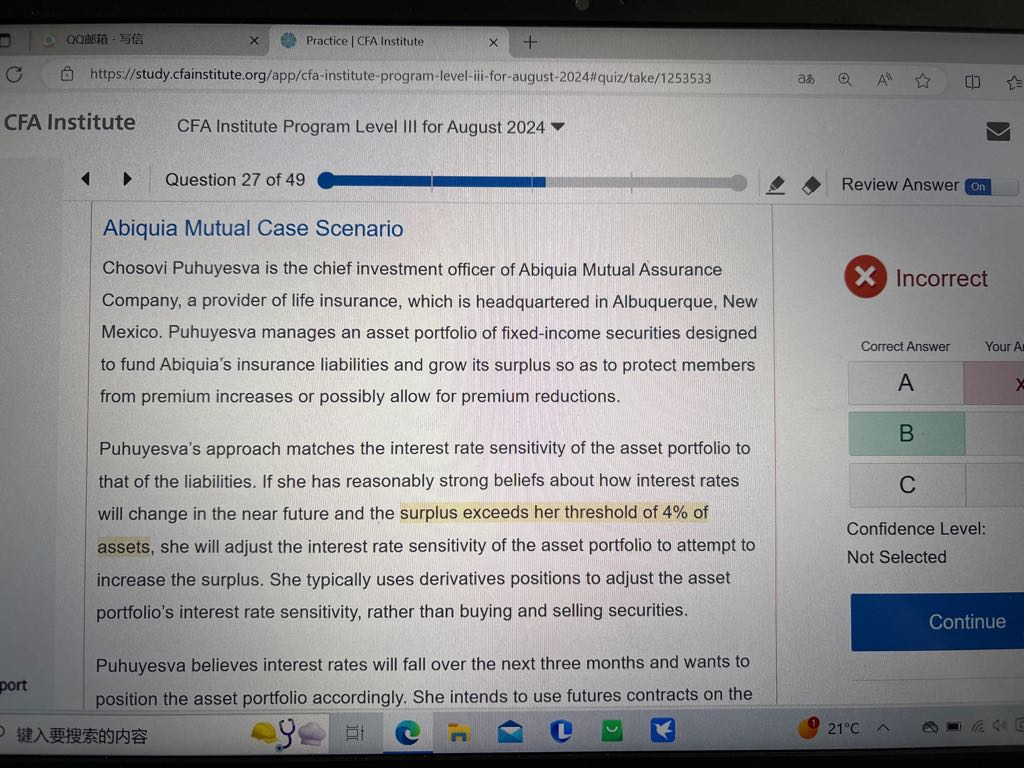

还是这道题,我知道考点是hedge ratio。1是不太能读懂黄色标记那句话代表什么意思。2是不知道r怎么变化

回答(1)

Evian, CFA2024-05-06 12:44:57

Evian, CFA2024-05-06 12:44:57

ヾ(◍°∇°◍)ノ゙你好同学,

1. 理解这句话需要关联“contingent immunization”

Contingent Immunization或有免疫:

当present value of asset portfolio 远大于 present value of liability,就产生了较明显的surplus,而这部分surplus并不会对免疫策略产生影响。因此可使用这部分surplus做主动投资,也可全部进行主动投资,但需要监控结束Contingent immunization的时间点。另外当actively managed portfolio < specified threshold→active management ceases。

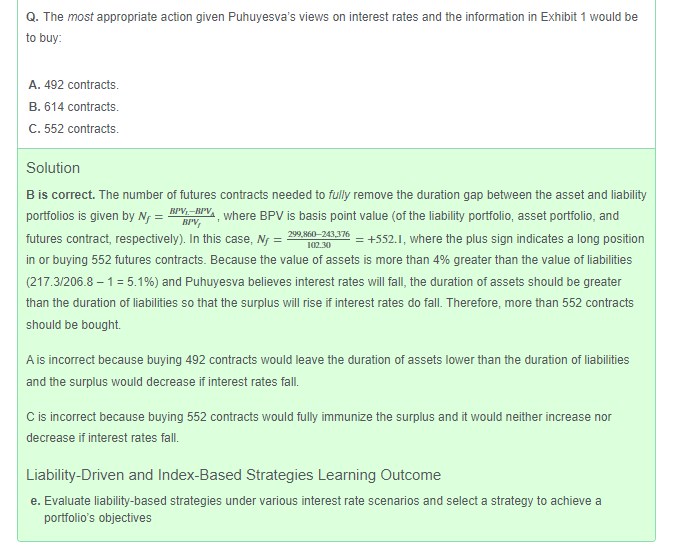

题目中标黄的内容“surplus exceeds her threshold of 4% of asset”

Puhuyesva设置了一个门槛值,门槛值=4% of asset

present value of asset portfolio - present value of liability = surplus > 4% of asset

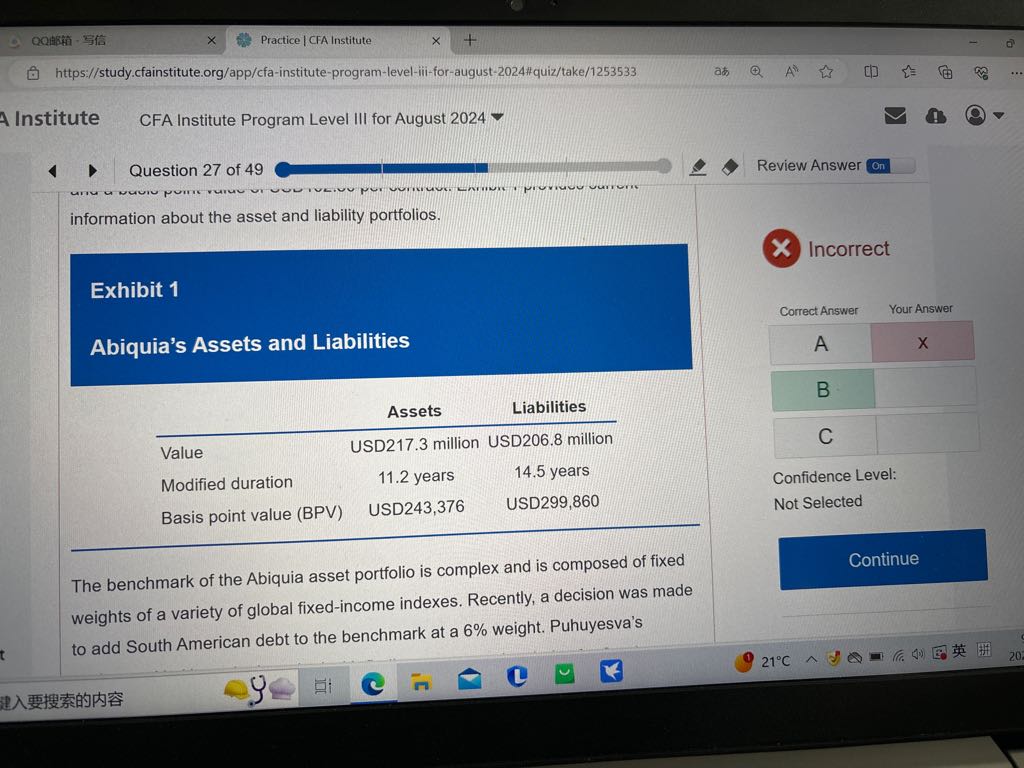

按照题目给的信息:USD217.3 million - USD206.8 million > 4% of USD217.3 million

用解析里的除法也可以说明同样的道理:Because the value of assets is more than 4% greater than the value of liabilities (217.3/206.8 – 1 = 5.1%)

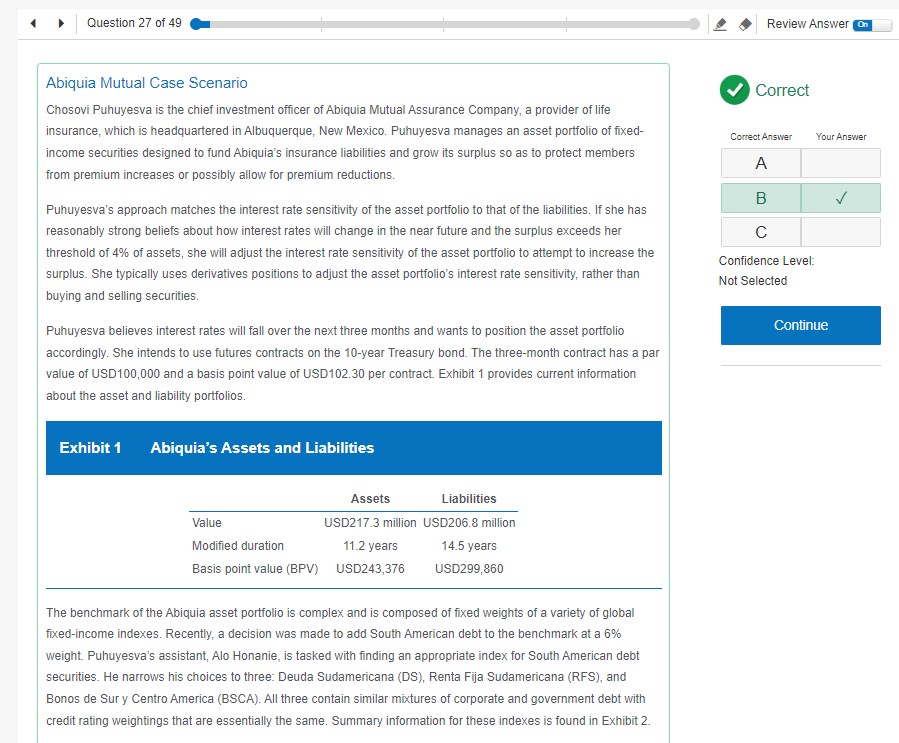

2.题目给了条件(Puhuyesva认为收益率会下降),请参考截图1,第三段话,第一行

“Puhuyesva believes interest rates will fall over the next three months and wants to position the asset portfolio accordingly”

---------------------

投资更加优秀的自己👍 ~如果满意答疑可【采纳】,仍有疑问可【追问】,您的声音是我们前进的源动力,祝您生活与学习愉快!~

- 评论(0)

- 追问(2)

- 追问

-

特别好!!!谢谢您~

- 追答

-

Best of luck on your exam !

评论

0/1000

追答

0/1000

+上传图片