186****97982022-02-14 00:20:51

186****97982022-02-14 00:20:51

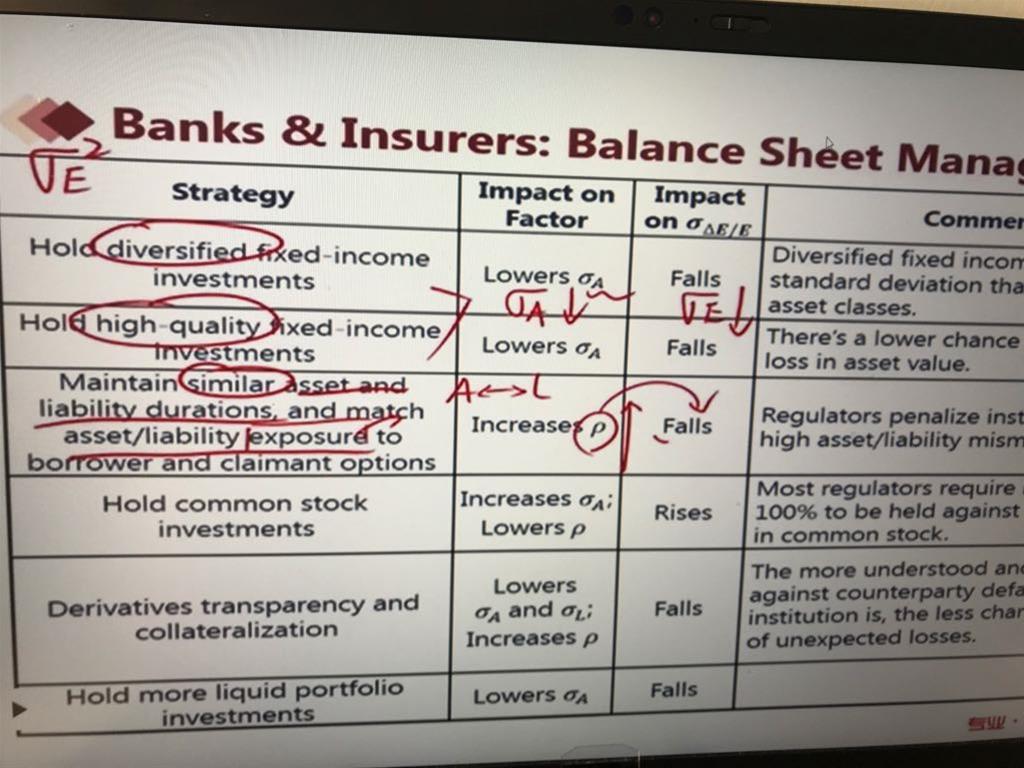

hold common stock为什么p会下降;derivatives transparency and collaterlizaion为什呢A和L的波动会下降

回答(1)

Chris Lan2022-02-14 09:26:37

Chris Lan2022-02-14 09:26:37

同学你好

common stock returns do not correlate well with financial institution returns, which pushes correlation, ρ, away from 1.0 toward 0.0.

第一点原版书上的解释是股票与金融机构(银行)的回报关系不大。银行主要是贷款,这是固定收益。固定收益和股票的相关性相对是低的。

Whether derivatives are used to hedge or synthesize (i) assets or (ii) liabilities, the more “plain vanilla” (and protected against counterparty default) they are, the less likely they will revalue in unexpected directions.

第二点原版书上的解释是,不管衍生品是被用来对冲还是合成资产还是负债,它们越普通(信息透明),并有抵押品(对手方不会违约),它们朝着意想不到的方向重估的可能性就越小。也就是说衍生品越透明,我就越了解,不容易判断错误,有抵押品也不会违约,这样我就能更好的利用衍生品做对冲或合成,从而降低波动。

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片