赵同学2021-05-08 08:57:03

赵同学2021-05-08 08:57:03

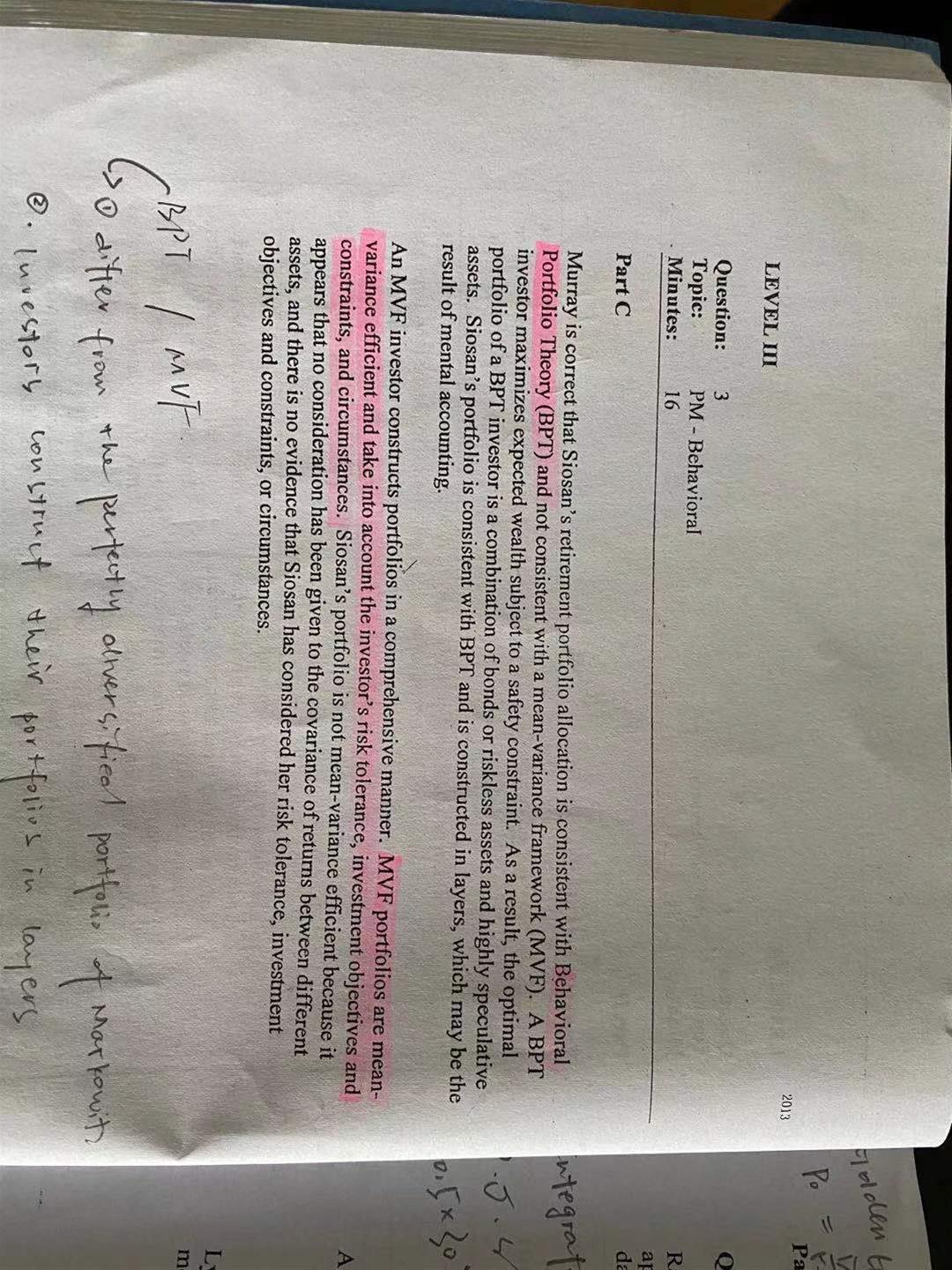

历年真题 - 行为金融学 - 2013年 C 可否概括成三个得分点? 1、Murray is correct that Siosan's retirement portfolio allocation is consistent with Behavioral Portfolio Theory and not consistent with a mean-variance framework. 2、BPT investors construct their portfolios in layers. Siosan's portfolio is consistent with BPT and is constructed in layers (money-market securities and speculative stocks) 3、"Mean-variance portfolios are constructed as a whole, and only the expected return and the variance of the entire portfolio matter"

回答(1)

Vito Chen2021-05-08 17:08:05

Vito Chen2021-05-08 17:08:05

同学你好。

还是出差的原因,请提供截图。

- 评论(0)

- 追问(2)

- 追问

-

截图所示

- 追答

-

其他基本是可以的。在第2点当中,最好把这个人怎么分成的说的清晰一些,也就是说无风险的投了什么,有风险的投了什么。

评论

0/1000

追答

0/1000

+上传图片