岳同学2020-11-20 10:12:26

岳同学2020-11-20 10:12:26

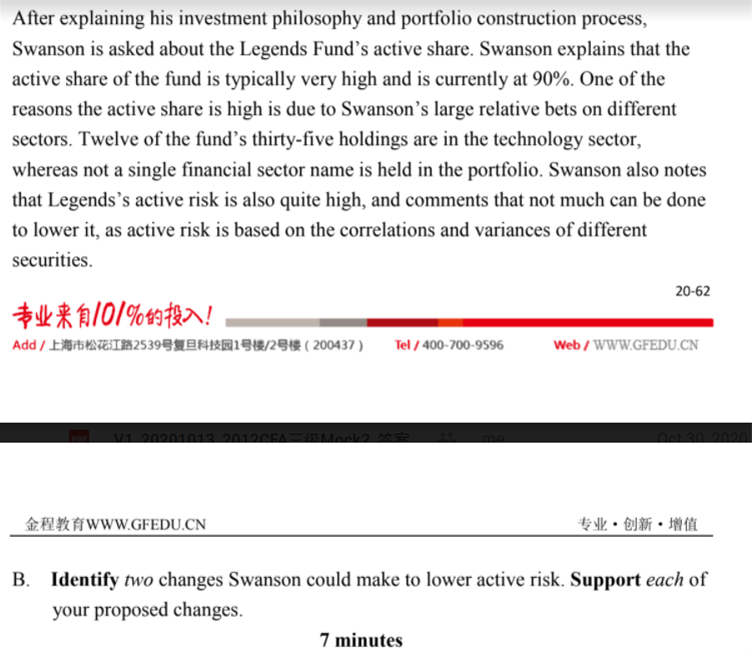

請問mock2 Q4B這樣寫是否需要加強,謝謝 1. Active risk increases when the risk factors of a portfolio are different from the risk factors of its benchmark. The investor can diversify his holdings or try to construct a portfolio similar to the benchmark because the active share of the portfolio is 90%, which indicates 90% of the holdings are different from the benchmark; 2. By holding a diversified portfolio, the active risk can be reduced. 3. A more diversified portfolio can lower the risk factors of a certain position and further lower the active risk of the portfolio; 4. Holding similar positions with the benchmark can effective reduce the active risk of the portfolio; 5. With similar holdings as the benchmark, the risk factors of the portfolio will match the risk factors of the benchmark and further decrease the active risk of the portfolio.

回答(1)

Kevin2020-11-20 15:09:38

Kevin2020-11-20 15:09:38

同学你好!

4和5意思差不多,2和3也是;

第1点,risk factor可能不同是没问题的,权重也可能不同(这点别遗漏)。

最好是像答案第1点写的,如何降低risk,比如哪几种方式等等,写得更详细一些。

致正在努力的你,望能解答你的疑惑~

如此次答疑能更好地帮助你理解该知识点,可以通过【点赞】来让我们知晓。你的反馈是我们进步的动力,祝你顺利通过考试~

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片