岳同学2020-11-11 10:38:59

岳同学2020-11-11 10:38:59

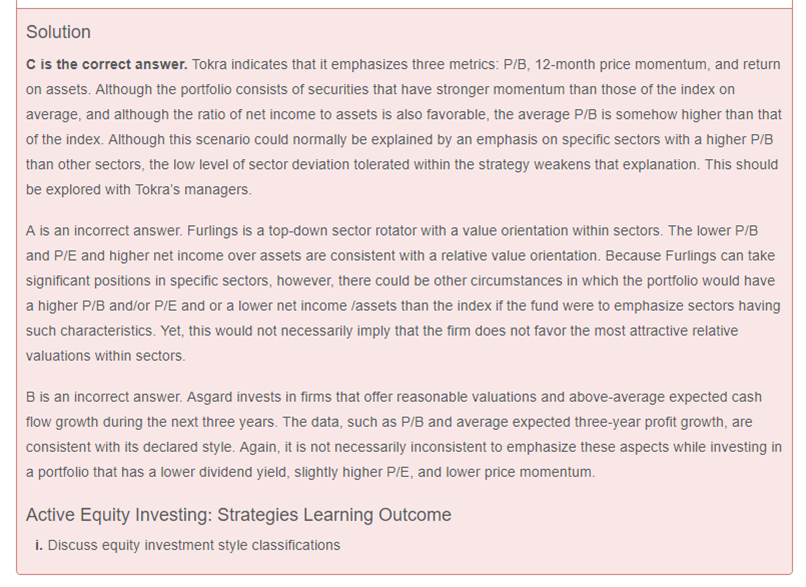

想請問這題有關於style declared。 Furilings說"favoring firms that have good governance, strong growth potential, competitive advantages such as branding, and attractive relative valuations" 還有"holds approximately 90 securities." 應該是growth-based approach + Quantatity approach 吧? 但是解答說前面說"Although Furlings is a top-down manager, its sector portfolios are built through investing in a small number of high-conviction securities after its analysts have dissected the financial statements and analyzed the competitive landscape and growth prospects. "但是後來又說"Furlings is a top-down sector rotator with a value orientation within sectors." 這幾題好像非常不清楚,請問怎樣判斷文中訊息比較不會被誤導?

回答(1)

开开2020-11-11 14:30:39

开开2020-11-11 14:30:39

同学你好,实际上这些描述实际上是讲的都是Furling投资风格的部分特征。F他是基本面投资者,而且是discretionary,而不是quantitative approach。而且他比较看attractive relative valuations, 但他也会对企业未来的growth potential进行判断,确保这个偏低的P/B P/E不是因为value trap造成的。

F可以说是Top down和bottom up结合的,top down体现会用宏观和行业指标去判断有优势的sectors;bottom up体现在sector 内的选股他是会分析财报及运用自己的经验、技能去分析企业的竞争力,未来成长前景等等的。

我们看题干的时候,信息很多,而且策略和风格并不一定是互斥的,非此即彼,基金经理可能会有一个结合,并有所偏向。这个时候,我们在大致浏览题干之后,就要根据题目去找信息,有时候比较模棱两可的就要用排除法,因为CFA经常问的就是least ,most。

致正在努力的你,望能解答你的疑惑~

如此次答疑能更好地帮助你理解该知识点,烦请【点赞】。你的反馈是我们进步的动力,祝你顺利通过考试~

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片