岳同学2020-11-09 16:50:16

岳同学2020-11-09 16:50:16

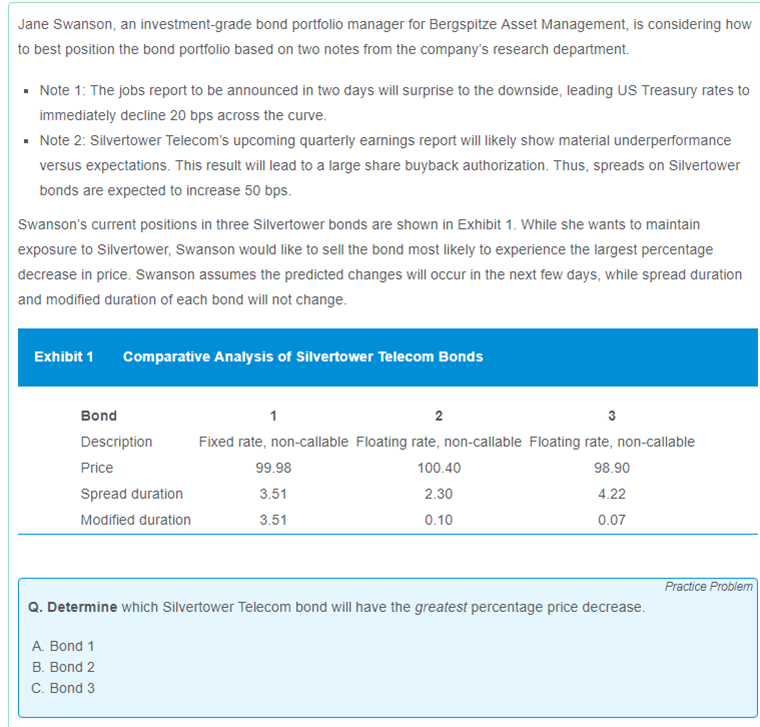

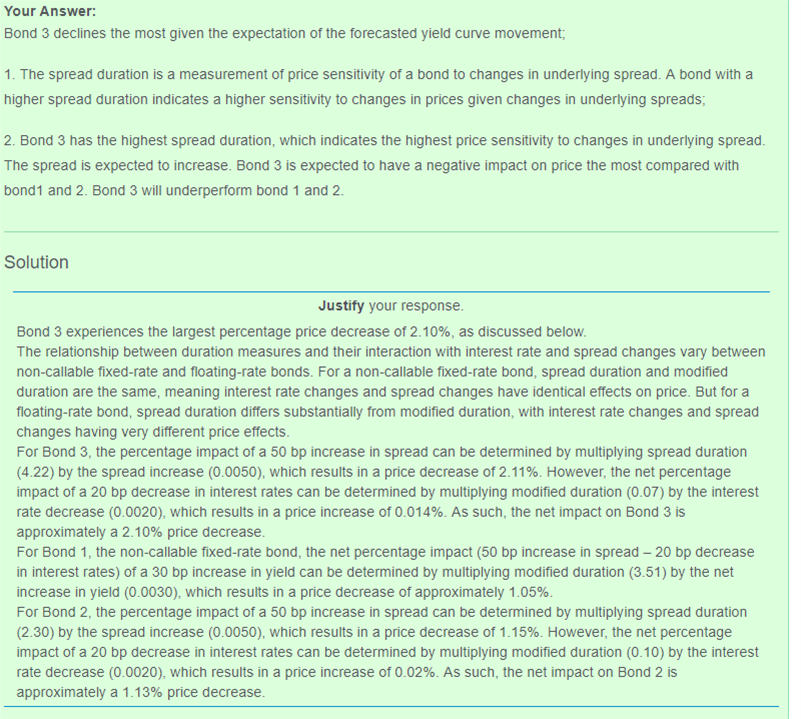

請問這題這樣的寫法有沒有需要加強的? Bond 3 declines the most given the expectation of the forecasted yield curve movement; 1. The spread duration is a measurement of price sensitivity of a bond to changes in underlying spread. A bond with a higher spread duration indicates a higher sensitivity to changes in prices given changes in underlying spreads; 2. Bond 3 has the highest spread duration, which indicates the highest price sensitivity to changes in underlying spread. The spread is expected to increase. Bond 3 is expected to have a negative impact on price the most compared with bond1 and 2. Bond 3 will underperform bond 1 and 2.

回答(1)

Nicholas2020-11-10 16:32:41

Nicholas2020-11-10 16:32:41

同学,下午好。

这里还是需要区分Duration和Spread duration,并且说明Fixed和Floating rate的区别,但是这样描述可能比较费时间。所以一个替代的解决方案就是分别计算出Benchmark 改变对价格的影响已经Spread改变对价格的影响,用数据说话,很明显我们会看到Bond 3的价格降低变动是最大的。

致正在努力的你,望能解答你的疑惑~

如此次答疑能更好地帮助你理解该知识点,烦请【点赞】。你的反馈是我们进步的动力,祝你顺利通过考试~

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片