曾同学2025-12-16 16:55:18

曾同学2025-12-16 16:55:18

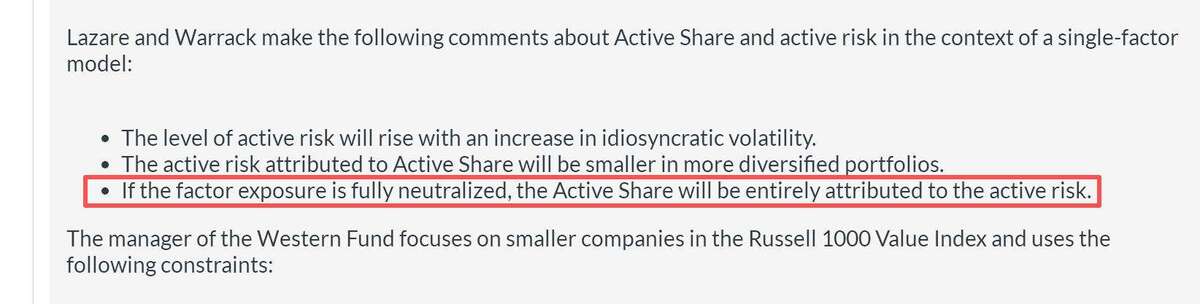

“If the factor exposure is fully neutralized, the Active Share will be entirely attributed to the active risk.”这句话什么意思,什么叫factor neutralized,然后为啥是错的呢?请详解

回答(1)

Simon2025-12-22 11:11:55

Simon2025-12-22 11:11:55

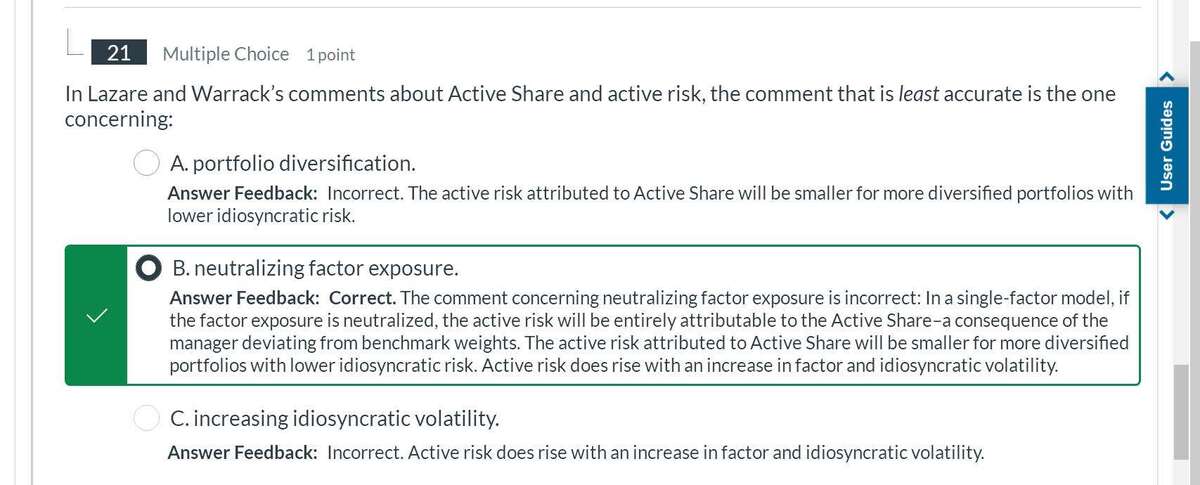

首先,active risk是衡量portfolio和benchmark的偏离程度的,简单来说,portfolio和benchmark越不像,active risk就越大。

然后,具体造成portfolio和benchmark不一样,可能有两种原因,一种是因子层面偏离factor deviation,一种是个股层面偏离active share。

如果 factor exposure is fully neutralized,说以因子层面,portfolio和benchmark一样,那么出现active risk,只能是active share。

所以正确说法是if the factor exposure is fully neutralized, the active risk will be entirely attributed to Active Share

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片