津同学2025-12-10 16:28:38

津同学2025-12-10 16:28:38

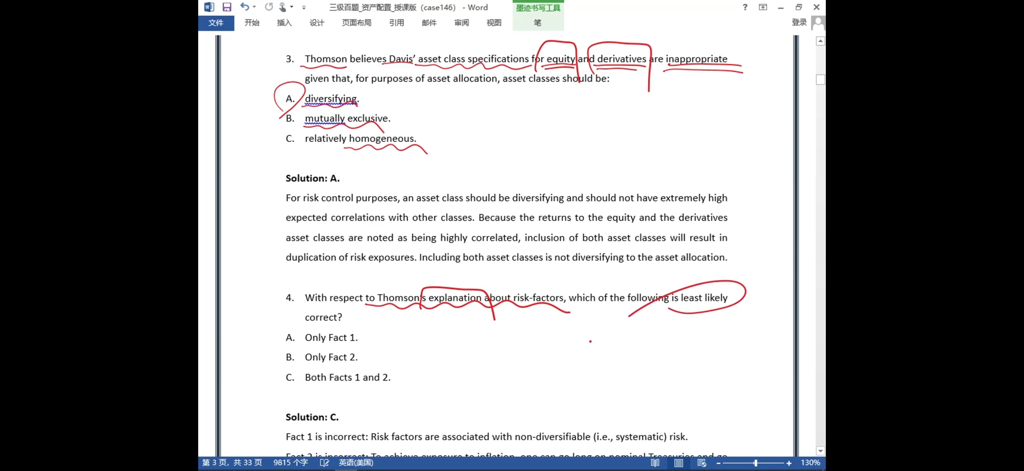

高度相关为什么不选互斥的B,而选分散化的A?

回答(1)

Vincent2025-12-11 09:09:15

Vincent2025-12-11 09:09:15

你好

在定义资产大类的标准里,互斥和分散化对应不同的情况,互斥是针对出现了两类资产定义包含了同一种资产,分散化是针对两类资产高度相关。

2. Asset classes should be mutually exclusive; overlapping asset classes will reduce the effectiveness of strategic asset allocation; E.g. US equity vs. global equity

3. Asset classes should be diversifying; should not have extremely high expected correlations with other asset classes or with a linear combination of other asset classes (ρ≤0.95).

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片