张同学2024-08-01 11:41:55

张同学2024-08-01 11:41:55

老师,这道题需要答哪些bullet point呢,答案写的太晦涩了

回答(1)

最佳

开开2024-08-02 10:30:22

开开2024-08-02 10:30:22

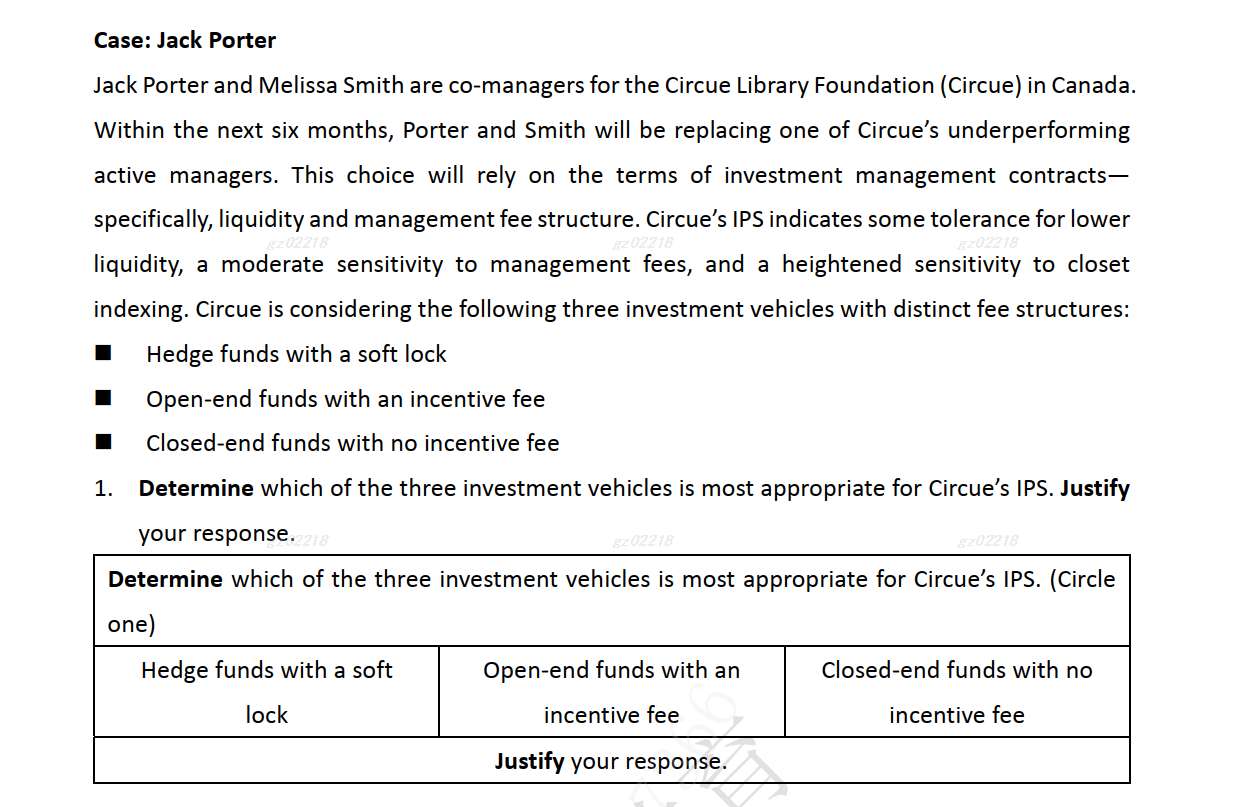

同学你好,这题问哪个投资工具最适合C。根据C的IPS,他对于低流动性有一些容忍度,对管理费有中等敏感度,对closet indexing高度敏感。因此这位投资者最不能接受的是closet indexing,即宣称是主动基金,但其实只是被动跟踪指数。

因为mutual fund的有规模粘性,只要上了一定AUM后,即使基金收益率下降投资者也不太愿意赎回,因此很可能会导致基金经理慢慢疏于主动管理,采用低成本的closet indexing。有业绩激励的Open-end fund就能有效激励基金经理采取主动管理,提高收益。而没有激励费的closed-end fund更有可能采用closet indexing。虽然Open-end fund流动性比closed-end fund稍差,但也是每日可以申赎的,C又对低流动性有一定的容忍度,因此是可以接受的。相比之下,hedge fund流动性是三者中最差的,而且soft lock意味着如果赎回需要支付赎回费,与C的IPS要求不符。因此有业绩激励的Open-end fund最为合适。

- 评论(0)

- 追问(1)

- 追答

-

答案可以写如下几点:

Open-end funds with an incentive fee are the most appropriate .

Circue’s IPS indicates some tolerance for lower liquidity, a moderate sensitivity to management fees, and a heightened sensitivity to closet indexing.(这个文中直接复制即可)

Although open-end fund is less liquid than closed-end fund, it still offers daily liquidity.

Hedge fund with a soft lock is the most illiquid and has the highest fee level among the three investment vehicles, therefore it is not suitable.

An incentive fee can motivate manager to work harder to improve performance rather than to be closet indexing.

Therefore close-end fund without incentive fee are less motivated, and less appropriate than open-end funds with an incentive fee due to Circue's heightened sensitivity to closet indexing.

评论

0/1000

追答

0/1000

+上传图片