Yuzuru2024-07-28 11:56:06

Yuzuru2024-07-28 11:56:06

第三问我对于A的理解是long payer swaption,支固定收浮动duration下降,那short payer就增duration。利率上升导致价格下跌,要降duration。为啥A对B呢?

回答(1)

Simon2024-08-01 13:45:55

Simon2024-08-01 13:45:55

同学,上午好。

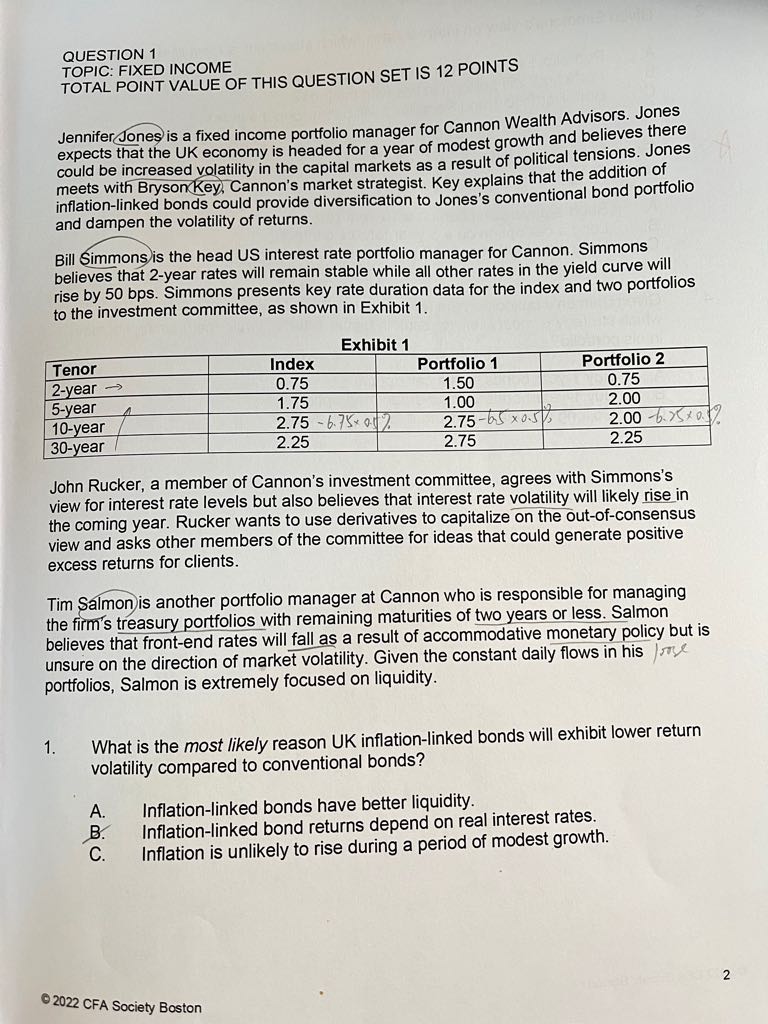

Rucker, a member of Cannon’s investment committee, agrees with Simmons’s view for interest rate levels,

然后Simmons believes that 2-year rates will remain stable while all other rates in the yield curve will rise by 50 bps

A选项是Short a payer swaption on a 10-year rate.,卖出一个option,对方支固定,收浮动,所以现在利率上涨,对方行权,我们对应收固定,支浮动,利率上涨时有亏损,被对方行权,亏损就是大亏。所以 least likely to generate excess portfolio returns

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片