王同学2022-03-24 21:12:38

王同学2022-03-24 21:12:38

请问原版书后reading24的14题的B,FCFE应该怎样算?

回答(1)

最佳

开开2022-03-25 16:32:09

开开2022-03-25 16:32:09

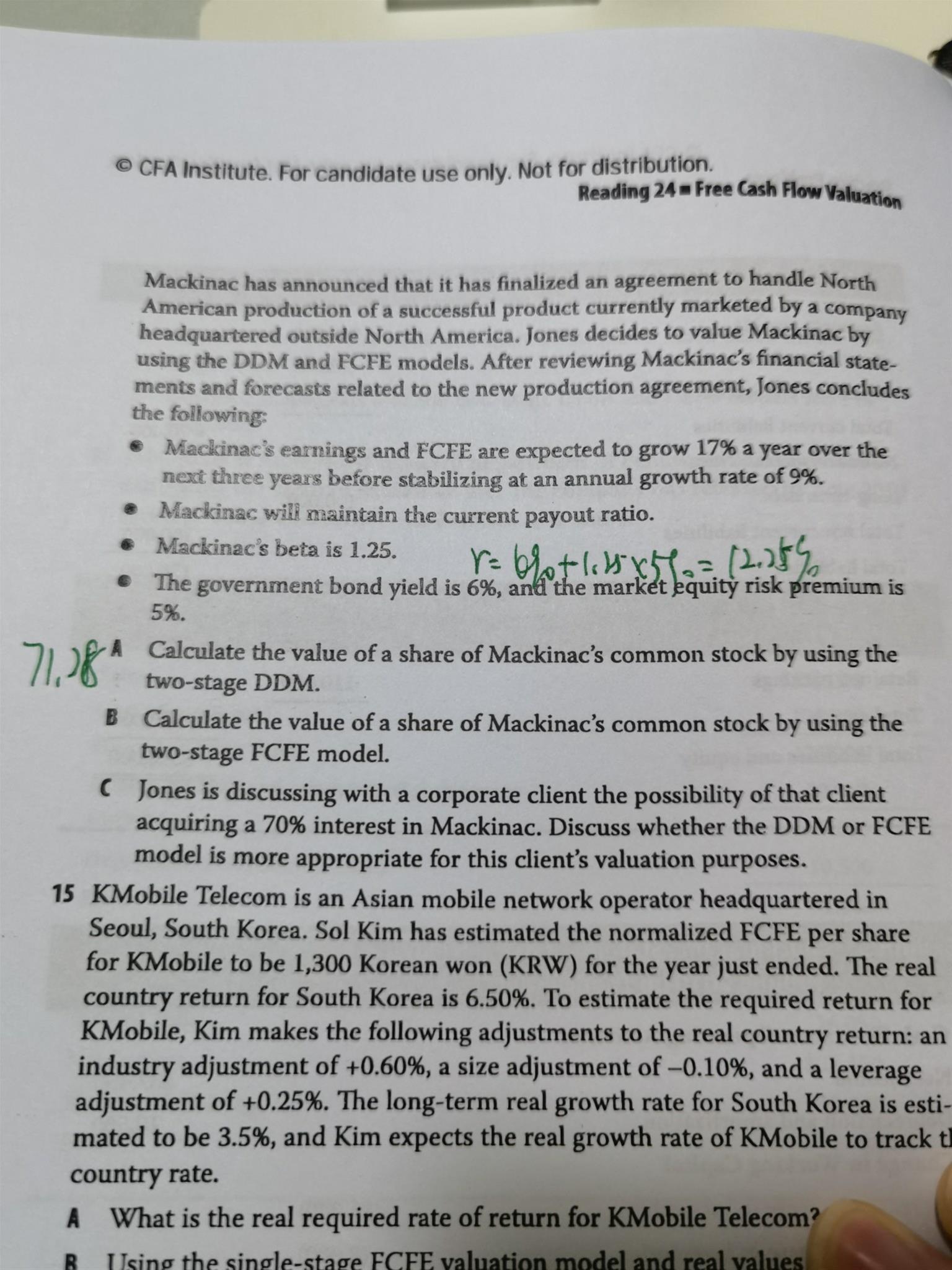

QB:让我用两阶段FCFE模型计算M的每股价值。

根据题干,

M贝塔系数是1.25, 国债收益率为6%,ERP为5%。因此re = 6%+1.25*5%=12.25%

根据表3

NI = $37,450.

Dep = $10,500.

根据表5

FCINV = Purchase of property, plant, and equipment= $15,000.

WCINV= Net change in working capital = $5,500.

Net borrowing= Change in debt outstanding = $4,000

FCFEo = NI + Dep - FCINV - WCINV +NB= $37,450 + $10,500 -$15,000 -$5,500 + $4,000=$31,450.

每股FCFEo= $31,450/13,000=$2.4192.

根据二阶段模型假设M的FCFE预计未来三年每年增长17%,之后稳定在9%,计算过程如下:

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片