郭同学2019-05-17 17:18:06

郭同学2019-05-17 17:18:06

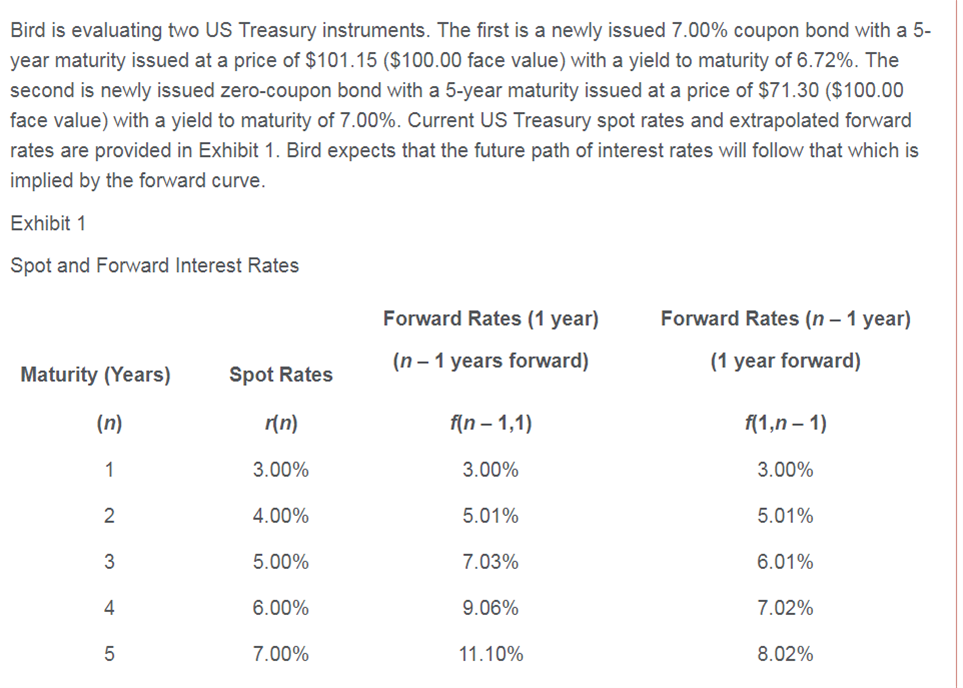

Q. Using the information provided in Exhibit 1 and assuming that Bird’s interest rate expectation materializes, the forward rate at which an investor would be indifferent to purchasing the US Treasury zero coupon note today or one year from today is closest to: 8.02%. 7.02%. 11.10%. 这道题应该就是考个概念吧,参照图1找到对应的一年期forward,但是对于应该是哪个没有思路,请讲解

回答(1)

Vito Chen2019-05-17 22:19:59

Vito Chen2019-05-17 22:19:59

同学你好。这道题根据你给出的已知条件,买一个五年期零息债等于现在买一个零息债和一年之后再买一个四年期的债券,所以就是8.02%

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片