-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6072提问数量:109459

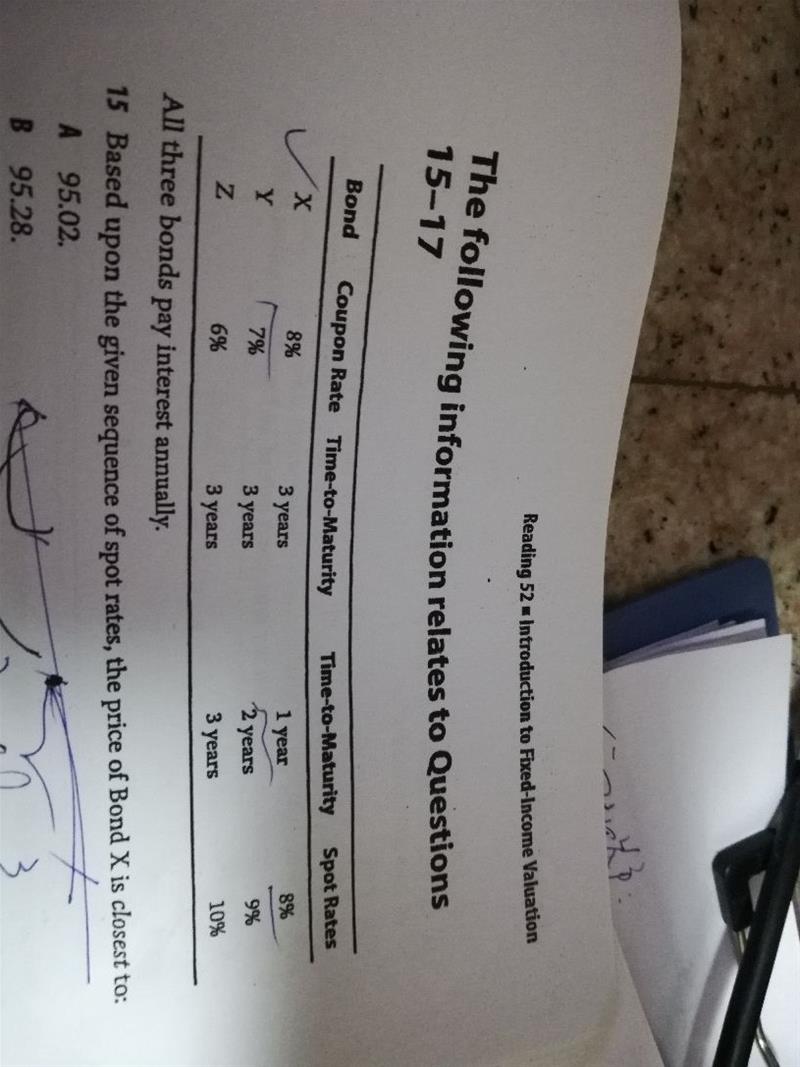

你好,原版书后题第247页,15题,关于这里的疑问,我看了题目给的SPOT RATE,分别是三个债券的各自对应的SPOT RATE,为什么如15题,算债券X的定价,用2年期,3年期SPOT RATE,用对应Y和Z的呢,是不是题目没有给X两年期,三年期 就用另外Y,Z的SPOT RATE 呢

31. Ash Lawn Partners, a fund of hedge funds, has the following fee structure: • 2/20 underlying fund fees with incentive fees calculated independently • Ash Lawn fees are calculated net of all underlying fund fees • 1% management fee (based on year-end market value) • 10% incentive fee calculated net of management fee • The fund and all underlying funds have no hurdle rate or high-water mark fee conditions In the latest year, Ash Lawn’s fund value increased from $100 million to $133 million before deduction of management and incentive fees of the fund or underlying funds. Based on the information provided, the total fee earned by all funds in the aggregate is closest to: A. $11.85 million. B. $12.75 million. C. $12.87 million. 麻烦老师讲解一下这道题,重点帮忙区分一下2/20 underlying fund fees with incentive fees calculated independently,此题用independently来计算,如果是dependently这种如何计算?

已解决精品问答

- 为什么半年付息 算ytm是乘以2 而年化的麦考利久期是除以2

- 为什么长期垄断竞争中 D和ATC相切

- m上升 EAR为什么上升 以及为什么又不变

- 为什么TC 的切点对应是AVC的最低点?

- 前面在讲Aggregate demand curve的时候说,价格上涨使消费下降,而这里又说价格下降消费变少,为什么存在矛盾?

- 为什么可以把TR TC同时体现在纵轴?

- 对于老师讲的这部分,1. 我理解FRA的Payoff始终等于利率期货的Payoff部分进行折现(除以1个大于1的数),也就是说,FRA的Payoff的变动幅度 应该 始终小于利率期货的变动幅度。2. 至于是涨多跌少,还是涨少跌多,其实MRR在分母上,可以根据1/x的曲线特点来理解,无非就是MRR上升时1/(1+MRR)的变动幅度 小于 MRR下降时1/(1+MRR)的变动幅度,所以如果MRR上升时,Payoff是上升的,那么就是涨少跌多,如果MRR上升时,Payoff是下降的,那就是涨多跌少。以上2点,我理解的对吗?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?