-

CFA一级

包含CFA一级传统在线课程、通关课程及试题相关提问答疑;

专场人数:6057提问数量:109067

老师您好 在financial reporting 有一节 credit analysis,的indicator of firm credit,有一句话:scale and diversification: a company's sensitivity to adverse events, adverse economic conditions, and their factors. 请问 公司对于负面事情的反应程度 敏锐度与分散性有什么关系呀?不是很懂这一条

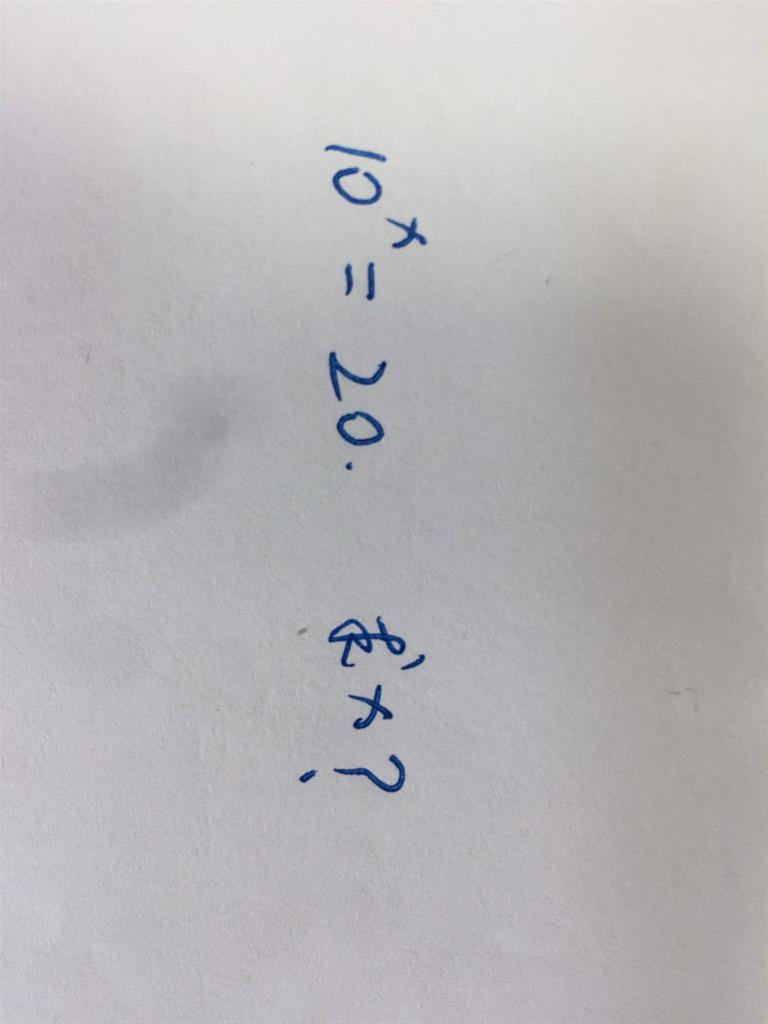

已回答The following 10 observations are a sample drawn from a normal population: 25, 20, 18, –5, 35, 21, –11, 8, 20, and 9. The fourth quintile (80th percentile) of the sample is closest to: A 24. B 8. C 21. 这题为什么不用(n+1)*80*=8.8,在数第八和第九之间那样做呢?

查看试题 已回答The following information is about the price earning (P/E) ratios for the common stocks held in a manager’s portfolio: The relative frequency and the cumulative relative frequency, respectively, for interval II are closest to: A Relative frequency is 20% ; Cumulative relative frequency is 85% B Relative frequency is 22%; Cumulative relative frequency is 36% C Relative frequency is 22%; Cumulative relative frequency is 85% 出错了。无答案

查看试题 已回答精品问答

- 为什么TC 的切点对应是AVC的最低点?

- 为什么可以把TR TC同时体现在纵轴?

- 为什么B选项要考虑借股还股?而A选项没有考虑借钱买然后还钱?可以都不考虑吗?还是借股还股一定要在这个流程中体现?

- 老师好,官网这道题我有点没太懂,麻烦讲解

- 老师您好!这个需要掌握吗?谢谢

- 是不是只有在市场均衡点,才是社会总福利不损失的点? 偏离市场均衡点,社会总福利都会损失? 因为要么生产过剩,要么就是总供给不足. 另外,为什么只有在完全竞争市场中才能实现社会总福利最优,才能有市场均衡点? 在其他各类市场中,不是需求供给需求也是有的吗?他们的均衡点难道不是市场均衡点吗? 在那个点声场不是可以实现社会总福利最优吗? 这点不是很清楚,老师可以画图说明下. 另外, 对于一级价格歧视这种,它又是怎么实现社会总福利不损失的,这时候的需求曲线和供给曲线是什么样的?和完全竞争市场不同吗

- 卖空股票价格必须要比之前交易价格更高这句话是什么意思? 是买入时的股票价格高于卖出时?那不是必然的吗?否则怎么赚钱? 还是说现在做空的价格要高于之前做空的价格. 请举个例子.

- 一级市场,二级市场, 公开发行/私募发行, 开放式和封闭式,这些关系是什么?可以互相组合吗? 按照老师说的,开放式基金只能通过基金公司买卖,那么是不是属于一级市场内的?而不是二级市场的?封闭式则属于二级市场的. 公募和私募的区别是买卖上市非上市股票,还是向市场所有人/部分人募集呢? 会存在上市公司股票只针对部分人募集一级非上市公司股票针对所有人募集的情况吧?