穆同学2024-07-03 23:30:59

穆同学2024-07-03 23:30:59

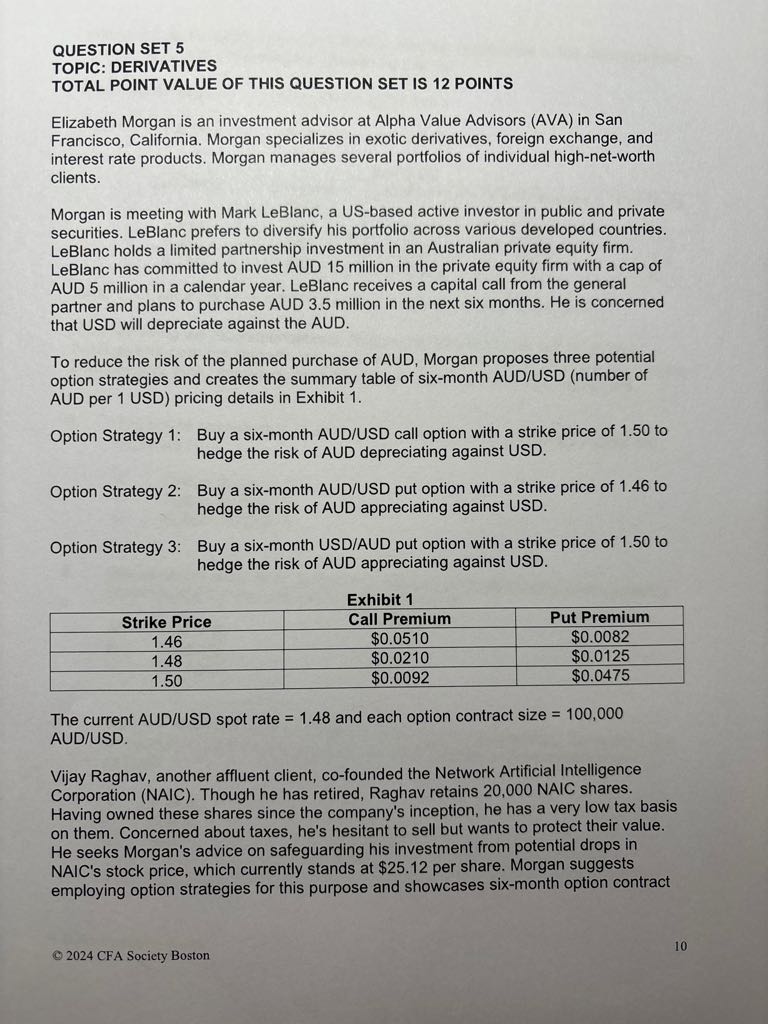

老师,mock,这个3题。为啥collar要atm的put,otm的call? 还有就是这个3题思路不理解。

回答(1)

Simon2024-07-08 14:03:27

Simon2024-07-08 14:03:27

同学,上午好。

1. collar一般都是用的OTM option。但因为题目要求he´s hesitant to sell but wants to protect their value,要保护原股票头寸的价值(价格25.12),所以买入ATM put=25。

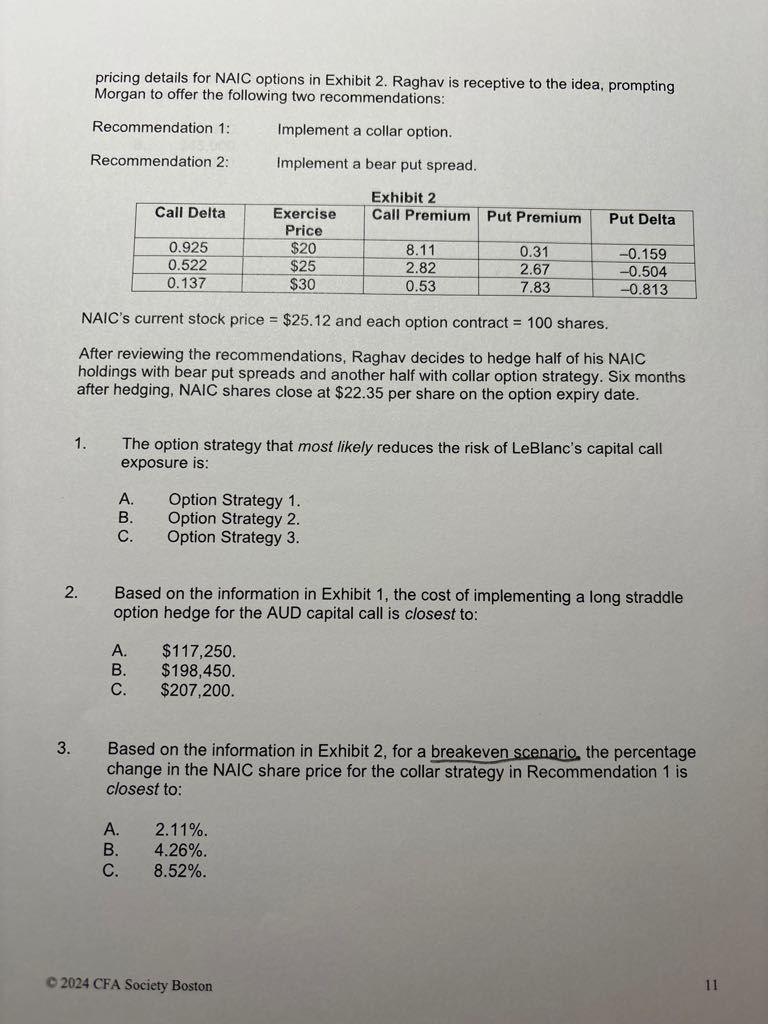

2. 第4题是half of his NAIC holdings with bear put spreads and another half with collar option strategy,所以总股数20000,有10000用collar,有10000用bear put。

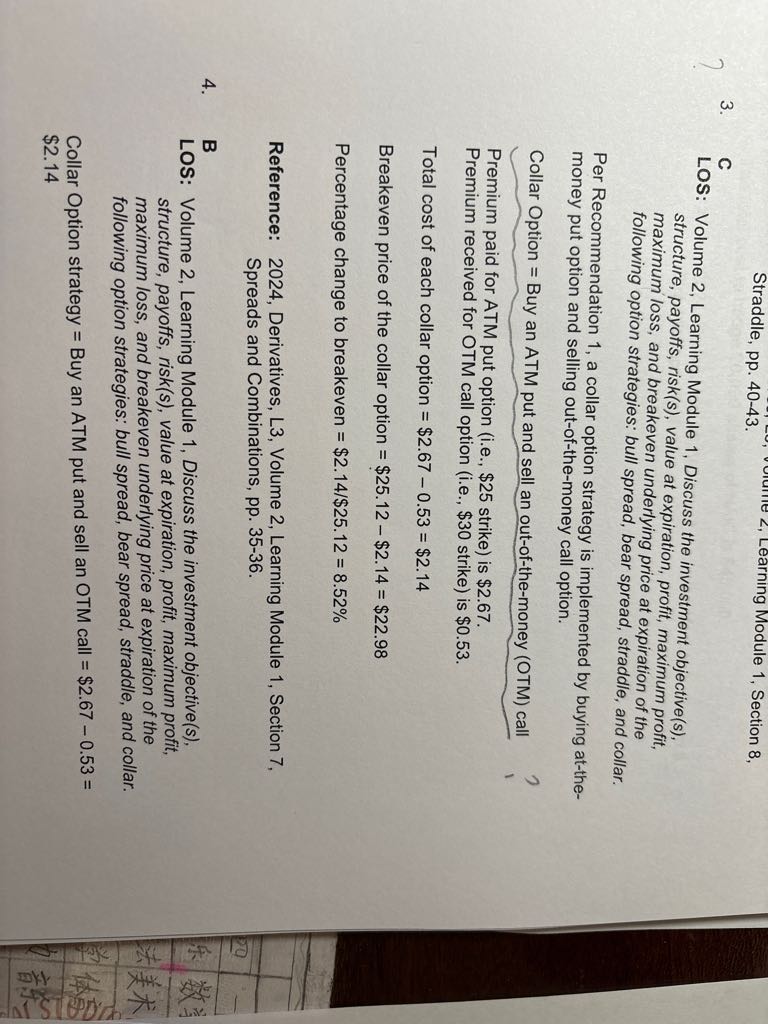

Collar Option strategy = Buy an ATM put and sell an OTM call = $2.67 – 0.53 = $2.14

Bear put option = Buy an ATM put and sell an OTM put = $2.67 – 0.31 = $2.36

所以成本=2.14*10000+2.36*10000=45,000

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片