陆同学2020-10-05 03:30:56

陆同学2020-10-05 03:30:56

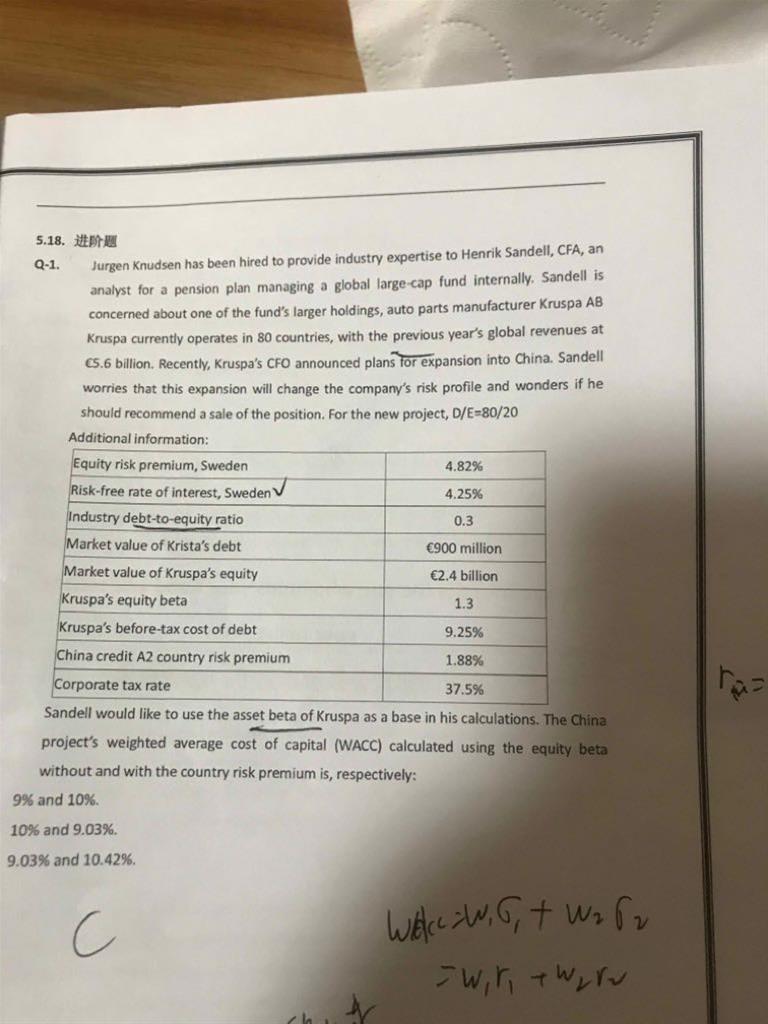

进阶第一题怎么做,能否具体解释。我的最大困难是如何求权益的r

回答(1)

Vicky2020-10-09 15:30:42

Vicky2020-10-09 15:30:42

同学你好,

这道题目的计算非常复杂,建议你去听一下进阶题的视频讲解。

先计算beta

Asset β = Un-levered β= 1.3/(1+[(1—0.375)(€900/€2400)] = 1.053 for prior to China project.

Projectβ= 1.053 { 1+ [(1 — 0.375) (€80/€20)] = 1.053 {3.5} = 3.686 for China project.

RE这里是分两种情况讨论的,

Cost of equity without the country risk premium: re =0.0425 + 3.686 (0.0482) = 22.02%

Cost of equity with the country risk premium: re = 0.0425 + 3.686 (0.0482 + 0.0188) = 28.95%

Weighted average cost of capital without the country risk premium:

WACC = [0.80 (0.0925) (1 — 0.375) + [0.20 (0.2202)] = 0.04625 + 0.04404 = 9.03%

Weighted average cost of capital with the country risk premium:

WACC = [0.80 (0.0925) (1 — 0.375) + [0.20 (0.2895)] = 0.04625 + 0.0579 = 10.42%

- 评论(0)

- 追问(0)

评论

0/1000

追答

0/1000

+上传图片